As global markets brace for pivotal central bank decisions, key currency pairs are showing mixed movement driven by monetary policy expectations, economic data, and geopolitical developments. The U.S. Federal Reserve’s interest rate decision later today remains the central focus for investors, with potential ripple effects across the FX landscape.

KEY HIGHLIGHTS

- EUR/USD Steady Near 1.1300 Ahead of Fed Decision

- GBP/USD Weakens as Dollar Gains Before BoE, Fed Moves

- AUD/USD Rallies on Domestic Data, Trade Talks Optimism

- USD/CAD Rises Despite Risk-On Mood, Eyes on Fed

EUR/USD: Consolidates Near 1.1300 Ahead of Fed Decision

Market Overview

EUR/USD traded in a tight range during Tuesday’s session, hovering near the 1.1300 mark. Traders are in a holding pattern ahead of the Federal Reserve’s highly anticipated interest rate decision. While the consensus expects no change in rates, the focus will be on Chair Jerome Powell’s tone regarding future monetary policy moves.

Key Drivers

- Market expectation of unchanged U.S. interest rates

- Political pressure for rate cuts from the Trump administration

- Fed’s mandate to balance employment and inflation objectives

Technical Overview

Moving Averages

Exponential MA

- MA 10: 1.1338 – Bullish (Positive Crossover)

- MA 20: 1.1283 – Bullish (Positive Crossover)

- MA 50: 1.1068 – Bullish (Positive Crossover)

Simple MA

- MA 10: 1.1351 – Bullish (Positive Crossover)

- MA 20: 1.1352 – Bullish (Positive Crossover)

- MA 50: 1.1026 – Bullish (Positive Crossover)

Indicators

- RSI: 59.19 – Buy Zone

- Stochastic Oscillator: 26.38 – Sell Zone / Neutral

Support and Resistance Levels

- Resistance: R1 – 1.1530 | R2 – 1.1718

- Support: S1 – 1.0923 | S2 – 1.0735

Overall Sentiment: Bullish

Market Direction: Buy

Trade Suggestion

- Entry: Limit Buy at 1.1239

- Target: Take Profit at 1.1473

- Risk: Stop Loss at 1.1111

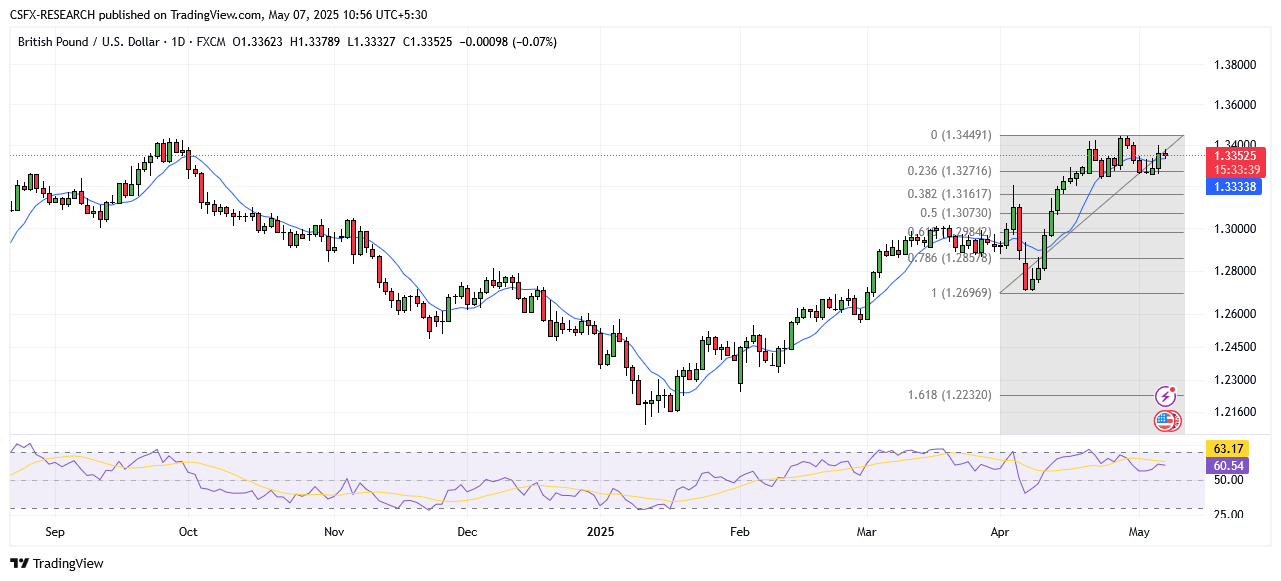

GBP/USD: Weakens Toward 1.3300 as Dollar Gains Traction

Market Overview

GBP/USD retreated during Asian hours, falling toward the 1.3400 level due to U.S. dollar strength. Traders are now focused on the Bank of England’s (BoE) policy announcement on May 8, where a rate cut is widely expected.

Key Drivers

- Expectations for a 25 or 50 basis point rate cut by the BoE

- Growing U.K. economic uncertainties

- Fed’s policy stance and commentary

Technical Overview

Moving Averages

Exponential MA

- MA 10: 1.3315 – Bullish

- MA 20: 1.3250 – Bullish

- MA 50: 1.3065 – Bullish

Simple MA

- MA 10: 1.3335 – Bullish

- MA 20: 1.3277 – Bullish

- MA 50: 1.3043 – Bullish

Indicators

- RSI: 60.44 – Buy Zone

- Stochastic Oscillator: 53.56 – Buy Zone / Neutral

Support and Resistance Levels

- Resistance: R1 – 1.3439 | R2 – 1.3613

- Support: S1 – 1.2878 | S2 – 1.2704

Overall Sentiment: Bullish

Market Direction: Buy

Trade Suggestion

- Entry: Limit Buy at 1.3300

- Target: Take Profit at 1.3443

- Risk: Stop Loss at 1.3233

AUD/USD: Extends Gains Near 0.6510 on Strong Domestic Data

Market Overview

AUD/USD remains on a bullish trajectory for a fourth session, climbing near the 0.6510 level. The pair is supported by positive Australian economic data and optimism surrounding U.S.-China trade developments.

Key Drivers

- AiG Industry Index and Manufacturing PMI showed improvement

- Scheduled U.S.-China trade talks signal easing tensions

- Fed policy outlook under close watch

Technical Overview

Moving Averages

Exponential MA

- MA 10: 0.6430 – Bullish

- MA 20: 0.6386 – Bullish

- MA 50: 0.6336 – Bullish

Simple MA

- MA 10: 0.6427 – Bullish

- MA 20: 0.6385 – Bullish

- MA 50: 0.6309 – Bullish

Indicators

- RSI: 62.57 – Buy Zone

- Stochastic Oscillator: 84.99 – Buy Zone / Neutral

Support and Resistance Levels

- Resistance: R1 – 0.6459 | R2 – 0.6585

- Support: S1 – 0.6050 | S2 – 0.5924

Overall Sentiment: Bullish

Market Direction: Buy

Trade Suggestion

- Entry: Limit Buy at 0.6452

- Target: Take Profit at 0.6551

- Risk: Stop Loss at 0.6398

USD/CAD: Rebounds to 1.3790 Despite Improved Risk Appetite

Market Overview

USD/CAD is recovering losses and trading near 1.3790 as markets turn cautious ahead of the Fed decision. Despite a slightly improved risk sentiment, the Canadian dollar remains under pressure from U.S. dollar strength.

Key Drivers

- Upcoming Fed announcement and Powell’s guidance

- U.S.-China trade discussions scheduled in Geneva

- Canadian Prime Minister Carney’s trade commentary

Technical Overview

Moving Averages

Exponential MA

- MA 10: 1.3822 – Bearish

- MA 20: 1.3888 – Bearish

- MA 50: 1.4042 – Bearish

Simple MA

- MA 10: 1.3819 – Bearish

- MA 20: 1.3848 – Bearish

- MA 50: 1.4134 – Bearish

Indicators

- RSI: 36.20 – Sell Zone

- Stochastic Oscillator: 21.92 – Sell Zone / Neutral

Support and Resistance Levels

- Resistance: R1 – 1.4238 | R2 – 1.4390

- Support: S1 – 1.3745 | S2 – 1.3593

Overall Sentiment: Bearish

Market Direction: Sell

Trade Suggestion

- Entry: Limit Sell at 1.3809

- Target: Take Profit at 1.3751

- Risk: Stop Loss at 1.3854

Other Currency Movements

- USD/CHF: +0.25% to 0.8242

- USD/JPY: +0.43% to 143.01

- EUR/GBP: +0.30% to 0.8507

- EUR/AUD: +0.13% to 1.7530

- AUD/NZD: -0.17% to 1.0792

- USD/CNY: +0.14% to 7.2261

- AUD/SEK: -0.38% to 6.1959

Key Economic Events – May 7, 2025

United States

- FOMC Statement: 23:30 GMT

- Fed Interest Rate Decision

- Forecast: 4.50%

- Previous: 4.50%