The forex market experiences increased volatility as the US dollar weakens, supporting major currency pairs such as EUR/USD and GBP/USD. Trade tensions escalate following President Trump’s tariff announcements, while key economic data—including US PCE and GDP figures—shape market sentiment amid evolving global monetary policy expectations.

KEY HIGHLIGHTS

- EUR/USD Recovers as US Dollar Weakens Amid Trade Concerns.

- GBP/USD Climbs Above 1.2900 on Falling US Treasury Yields.

- USD/JPY Holds Below Mid-150s Despite Weaker US Dollar.

- NZD/USD Drops Below 0.5750 Amid Trade War Uncertainty.

Markets in Focus Today

EUR/USD Analysis

EUR/USD rebounds from multi-week low as USD weakens

The EUR/USD pair recovers from a three-week low, climbing from the 1.0735-1.0730 zone during Thursday’s Asian session. The pair gains momentum, reaching the 1.0780 region, fueled by renewed selling pressure on the US Dollar (USD). The USD Index (DXY), which measures the Greenback against a basket of major currencies, retreats after hitting a three-week high as concerns over a potential economic slowdown arise due to US trade policies under President Trump.

In a recent move, Trump announced a 25% tariff on imported cars and light trucks, effective next week, with a one-month exemption for auto parts. This follows a 25% tariff on all steel and aluminum imports and planned reciprocal tariffs set for April 2, further increasing market uncertainty. Meanwhile, the European Union (EU) has vowed to retaliate by imposing tariffs on US imports.

Market participants focus on upcoming US economic data, including the final Q4 GDP report, Weekly Initial Jobless Claims, and Pending Home Sales figures. Additionally, speeches from key Federal Open Market Committee (FOMC) members will influence USD sentiment. However, the primary market driver remains Friday’s release of the US Personal Consumption Expenditure (PCE) Price Index.

Technical Analysis

Moving Averages:

- Exponential:

- MA 10: 1.0801 | Negative Crossover | Bearish

- MA 20: 1.0760 | Positive Crossover | Bullish

- MA 50: 1.0638 | Positive Crossover | Bullish

- Simple:

- MA 10: 1.0840 | Negative Crossover | Bearish

- MA 20: 1.0788 | Negative Crossover | Bearish

- MA 50: 1.0565 | Positive Crossover | Bullish

Indicators:

- RSI: 54.21 | Buy Zone | Bullish

- Stochastic Oscillator: 9.63 | Neutral Zone | Neutral

Resistance & Support Levels:

- R1: 1.0493 | R2: 1.0568

- S1: 1.0249 | S2: 1.0174

Trade Suggestion:

- Limit Buy: 1.0687

- Take Profit: 1.0871

- Stop Loss: 1.0585

GBP/USD Analysis

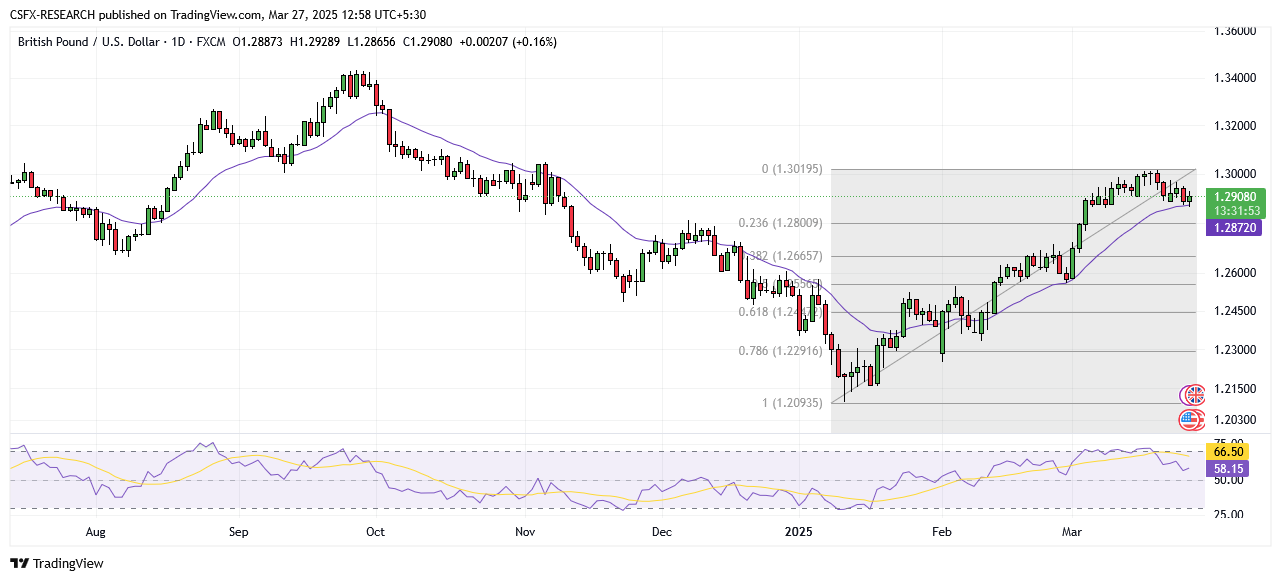

GBP/USD strengthens past 1.2900 as US yields decline

GBP/USD rebounds from previous losses, advancing toward 1.2910 during Thursday’s Asian session. The pair gains traction as the US Dollar weakens under pressure from falling Treasury yields, with the 2-year and 10-year yields hovering at 4.0% and 4.34%, respectively.

Traders focus on upcoming US economic data, including Initial Jobless Claims and the final Q4 GDP Annualized report. However, GBP/USD’s upside may be limited as trade tensions escalate following Trump’s 25% tariff on auto imports, set to take effect on April 2. The British Pound (GBP) also faces challenges as the UK Consumer Price Index (CPI) report indicates a sharper-than-expected decline in inflation. This has reinforced expectations that the Bank of England (BoE) may adopt a more accommodative monetary policy.

Technical Analysis

Moving Averages:

- Exponential:

- MA 10: 1.2918 | Negative Crossover | Bearish

- MA 20: 1.2871 | Positive Crossover | Bullish

- MA 50: 1.2740 | Positive Crossover | Bullish

- Simple:

- MA 10: 1.2944 | Negative Crossover | Bearish

- MA 20: 1.2896 | Positive Crossover | Bullish

- MA 50: 1.2648 | Positive Crossover | Bullish

Indicators:

- RSI: 57.36 | Buy Zone | Neutral

- Stochastic Oscillator: 29.19 | Sell Zone | Neutral

Resistance & Support Levels:

- R1: 1.2691 | R2: 1.2801

- S1: 1.2335 | S2: 1.2225

Trade Suggestion:

- Limit Buy: 1.2815

- Take Profit: 1.3015

- Stop Loss: 1.2695

USD/JPY Analysis

Japanese Yen pares gains as USD remains under pressure

The Japanese Yen (JPY) surrenders some intraday gains following an early uptick in the Asian session. However, a modest pullback in the USD keeps USD/JPY trading below mid-150.00s.

Key data releases such as Tokyo’s Consumer Price Index (CPI) and US PCE Price Index on Friday could provide further direction.

Technical Analysis

- Limit Buy: 149.52

- Take Profit: 150.97

- Stop Loss: 148.82

NZD/USD Analysis

NZD/USD slips below 0.5750 as trade war concerns persist

NZD/USD trades near 0.5730, weighed down by concerns over a potential Reserve Bank of New Zealand (RBNZ) rate cut. Despite stronger GDP data, economists still anticipate an Official Cash Rate (OCR) reduction in April and May.

Technical Analysis

- Limit Sell: 0.5770

- Take Profit: 0.5711

- Stop Loss: 0.5807

Elsewhere in the Forex Market

- AUD/USD up 0.18% to 0.6308

- USD/CAD up 0.16% to 1.4291

- EUR/GBP down 0.08% to 0.8337

- USD/CNY down 0.04% to 7.2644

Key Economic Events Today:

- (USD) U.S. President Trump Speaks at 06:30

- (USD) GDP (QoQ) (Q4) Forecast: 2.3%, Previous: 3.1% at 18:00

- (USD) Initial Jobless Claims Forecast: 225K, Previous: 223K at 18:00