Global stock markets faced mixed movements as concerns over President Donald Trump’s newly announced auto tariffs weighed heavily on investor sentiment. Asian markets mostly declined amid uncertainty in AI data centers, while European stocks retreated due to rising trade tensions. Meanwhile, Wall Street futures remained subdued as auto stocks extended losses following Trump’s latest trade measures.

KEY HIGHLIGHTS

- Nasdaq 100 Declines Sharply as Auto Tariff Concerns Grow.

- S&P 500 Weakens as Trump’s Tariffs Shake Market Confidence.

- FTSE 100 Falls as Risk Appetite Deteriorates on Tariffs.

- Wall Street Futures Remain Subdued Amid Auto Stock Losses.

Market in Focus Today – Nasdaq 100

The Nasdaq 100 experienced a sharp decline as investor sentiment weakened following Trump’s announcement of a 25% tariff on imported automobiles.

Technical Overview

Moving Averages:

Exponential:

- MA 5: 20,043.1 | Positive Crossover | Bullish

- MA 20: 20,120.1 | Negative Crossover | Bearish

- MA 50: 20,820.0 | Negative Crossover | Bearish

Simple:

- MA 5: 19,970.1 | Positive Crossover | Bullish

- MA 20: 19,876.5 | Negative Crossover | Bearish

- MA 50: 21,224.4 | Negative Crossover | Bearish

Indicators:

- RSI (Relative Strength Index): 46.42 | Neutral Zone | Neutral

- Stochastic Oscillator: 84.17 | Buy Zone | Neutral

Resistance and Support Levels:

- R1: 20,490.19 | R2: 21,166.89

- S1: 19,814.85 | S2: 19,177.78

Overall Sentiment: Bearish

Market Direction: Sell

Trade Suggestion: Limit Sell: 20,299.14 | Take Profit: 19,820.53 | Stop Loss: 20,642.03

S&P 500 Declines Amid Trade War Concerns

Investor confidence in the S&P 500 weakened amid heightened concerns over Trump’s tariffs.

Technical Overview

Moving Averages:

Exponential:

- MA 5: 5,736.30 | Positive Crossover | Bullish

- MA 20: 5,748.44 | Negative Crossover | Bearish

- MA 50: 5,886.61 | Negative Crossover | Bearish

Simple:

- MA 5: 5,722.20 | Positive Crossover | Bullish

- MA 20: 5,694.78 | Positive Crossover | Bullish

- MA 50: 5,961.91 | Negative Crossover | Bearish

Indicators:

- RSI: 46.29 | Neutral Zone | Neutral

- Stochastic Oscillator: 86.59 | Buy Zone | Negative

Resistance and Support Levels:

- R1: 5,834.58 | R2: 6,014.61

- S1: 5,683.21 | S2: 5,542.64

Overall Sentiment: Bearish

Market Direction: Sell

Trade Suggestion: Limit Sell: 5,813.22 | Take Profit: 5,715.36 | Stop Loss: 5,884.99

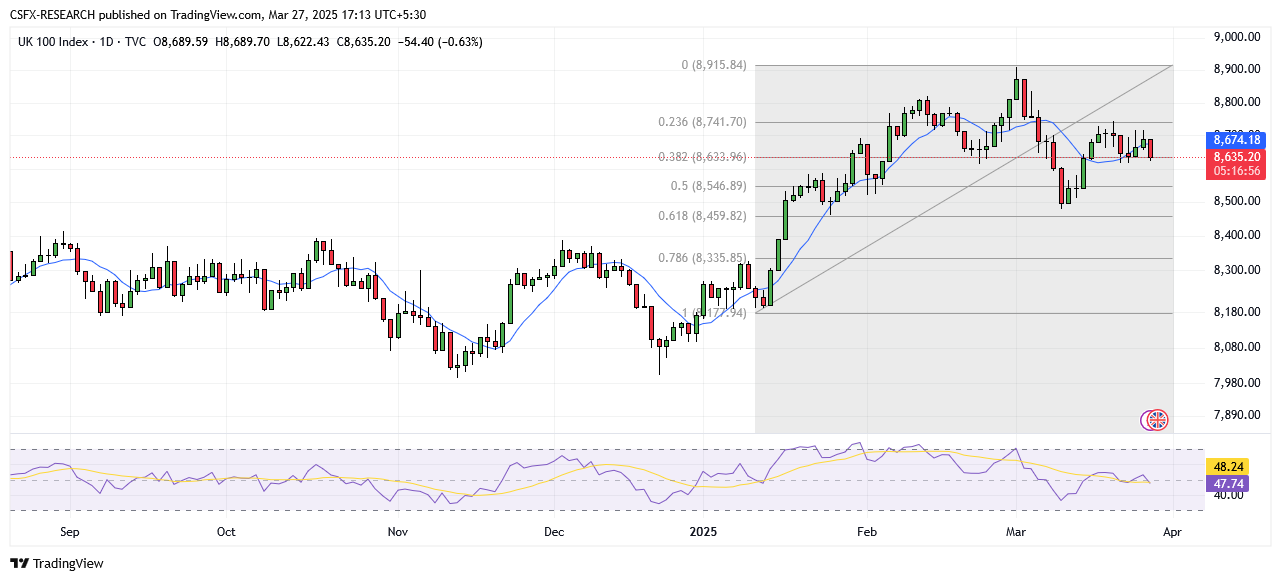

FTSE 100 Drops as Risk Appetite Diminishes

The FTSE 100 fell as investors remained cautious over Trump’s trade policies.

Technical Overview

Moving Averages:

Exponential:

- MA 5: 8,662.35 | Negative Crossover | Bearish

- MA 20: 8,667.41 | Negative Crossover | Bearish

- MA 50: 8,504.00 | Positive Crossover | Bullish

Simple:

- MA 5: 8,675.76 | Negative Crossover | Bearish

- MA 20: 8,682.73 | Negative Crossover | Bearish

- MA 50: 8,436.48 | Positive Crossover | Bullish

Indicators:

- RSI: 47.22 | Neutral Zone | Neutral

- Stochastic Oscillator: 71.31 | Buy Zone | Positive

Resistance and Support Levels:

- R1: 8,718.3 | R2: 8,836.2

- S1: 8,594.1 | S2: 8,466.7

Overall Sentiment: Neutral

Market Direction: Sell

Trade Suggestion: Limit Buy: 8,659.79 | Take Profit: 8,390.00 | Stop Loss: 8,758.65

Elsewhere in the Indices Market

Asian Markets:

- Shanghai Composite: +0.15%

- Singapore MSCI: +0.58% to 399.07

- Hang Seng Index: +0.40% to 23,578.80

- Nikkei 225: -0.60% to 37,799.97

- Topix Index: +0.09% to 2,815.47

- Kospi (South Korea): -1.41% to 2,607.15

- S&P/ASX 200 (Australia): -0.38% to 7,969.00

European Markets:

- DAX (Germany): -0.82%

- CAC 40 (France): -0.41% to 7,998.01

- FTSE 100 (UK): -0.55% to 8,639.73

Wall Street Futures:

- Dow Jones: +0.21%

- S&P 500: +0.01%

- Nasdaq: +0.1%

Corporate News

- NVIDIA Corp (NVDA): -5.74% at 113.76

- Amazon (AMZN): -2.23% at 201.13

- Apple Inc. (AAPL): -0.99% at 221.53

- Goldman Sachs (GS): -2.05% at 573.92

- Morgan Stanley (MS): -2.40% at 112.20

Key Economic Events & Data Releases Today

- U.S. President Trump Speaks at 06:30 (UTC)

- U.S. GDP (QoQ) (Q4): Forecast 2.3%, Previous 3.1% at 18:00 (UTC)

- U.S. Initial Jobless Claims: Forecast 225K, Previous 223K at 18:00 (UTC)