Global stock markets witnessed a strong rally as investor sentiment was lifted by signs of easing tensions between U.S. President Donald Trump and the Federal Reserve, along with positive signals on U.S.-China trade negotiations. Asian and European indices advanced, while U.S. stock futures climbed on hopes of a more accommodative stance on both monetary policy and trade.

KEY HIGHLIGHTS

- Nasdaq 100 Jumps 2% After Trump Supports Fed Chairman

- S&P 500 Surges On Eased Fed, China Trade Concerns

- FTSE 100 Climbs As Tariff Uncertainty Begins To Fade

- Asian, European Markets Rally On Hopes Of Trade Progress

Market in Focus: Nasdaq 100

Nasdaq 100 advanced 2% after President Trump confirmed his support for Federal Reserve Chair Jerome Powell, easing concerns about central bank independence and improving investor sentiment.

Technical Overview

Moving Averages

- Exponential:

- MA 5: 18,486.1 | Positive Crossover | Bullish

- MA 20: 18,611.1 | Positive Crossover | Bullish

- MA 50: 19,905.6 | Negative Crossover | Bearish

- Simple:

- MA 5: 18,500.1 | Positive Crossover | Bullish

- MA 20: 18,389.5 | Positive Crossover | Bullish

- MA 50: 20,445.4 | Negative Crossover | Bearish

Indicators

- RSI (Relative Strength Index): 51.94 | Bullish Zone | Buy

- Stochastic Oscillator: 67.39 | Buy Zone | Neutral

Resistance and Support Levels

- R1: 19,182.19 | R2: 20,000.31

- S1: 18,364.25 | S2: 17,492.77

Overall Sentiment: Neutral

Market Direction: Buy

Trade Suggestion:

- Limit Sell: 18,344.96

- Take Profit: 19,841.12

- Stop Loss: 17,562.17

S&P 500

S&P 500 rose sharply following Trump’s softened approach on both Fed leadership and China tariffs, which boosted investor confidence across the board.

Technical Overview

Moving Averages

- Exponential:

- MA 5: 5,339.15 | Positive Crossover | Bullish

- MA 20: 5,290.84 | Positive Crossover | Bullish

- MA 50: 5,792.61 | Negative Crossover | Bearish

- Simple:

- MA 5: 5,336.20 | Positive Crossover | Bullish

- MA 20: 5,368.78 | Positive Crossover | Bullish

- MA 50: 5,573.91 | Negative Crossover | Bearish

Indicators

- RSI: 51.73 | Bullish Zone | Buy

- Stochastic Oscillator: 73.94 | Buy Zone | Neutral

Resistance and Support Levels

- R1: 5,500.61 | R2: 5,742.93

- S1: 5,252.07 | S2: 5,015.95

Overall Sentiment: Neutral

Market Direction: Buy

Trade Suggestion:

- Limit Buy: 5,360.75

- Take Profit: 5,570.49

- Stop Loss: 5,242.02

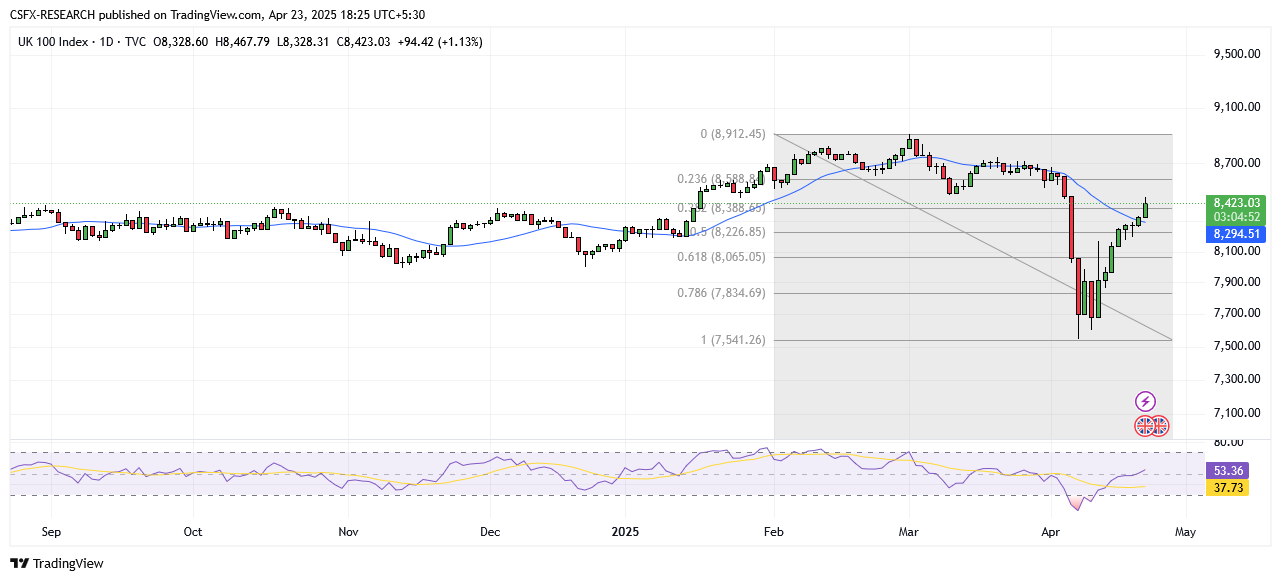

FTSE 100

FTSE 100 surged as global tariff concerns subsided and market sentiment turned bullish.

Technical Overview

Moving Averages

- Exponential:

- MA 5: 8,257.74 | Positive Crossover | Bullish

- MA 20: 8,306.41 | Positive Crossover | Bullish

- MA 50: 8,427.00 | Negative Crossover | Bearish

- Simple:

- MA 5: 8,151.76 | Positive Crossover | Bullish

- MA 20: 8,308.73 | Positive Crossover | Bullish

- MA 50: 8,452.48 | Positive Crossover | Bullish

Indicators

- RSI: 53.17 | Buy Zone | Bullish

- Stochastic Oscillator: 100 | Bullish Zone | Positive

Resistance and Support Levels

- R1: 8,507.8 | R2: 8,745.2

- S1: 8,276.1 | S2: 8,050.8

Overall Sentiment: Bullish

Market Direction: Buy

Trade Suggestion:

- Stop Buy: 8,469.6

- Take Profit: 8,745.0

- Stop Loss: 8,288.5

Global Indices Performance

Asia-Pacific Markets

- Shanghai Composite: Down 0.10%

- Singapore MSCI: Up 0.78% to 380.73

- Hang Seng (Hong Kong): Up 2.31% to 22,072.62

- Nikkei 225 (Japan): Up 1.86% to 34,868.63

- Topix (Japan): Up 2.06% to 2,584.32

- Kospi (South Korea): Up 1.54% to 2,525.56

- S&P/ASX 200 (Australia): Up 1.33% to 7,920.50

European Markets

- DAX (Germany): Up 2.40%

- CAC 40 (France): Up 2.05% to 7,476.79

- FTSE 100 (UK): Up 1.25% to 8,432.63

U.S. Futures and Indexes

- Dow Jones: Up 1.5%

- S&P 500: Up 2%

- Nasdaq 100: Up 2.4%

Corporate News

- NVIDIA Corp (NVDA): Up 2.04% to 98.89

- Amazon.com Inc (AMZN): Up 3.50% to 173.18

- Apple Inc. (AAPL): Up 3.41% to 199.74

- Goldman Sachs (GS): Up 3.72% to 519.99

- Morgan Stanley (MS): Up 3.84% to 110.38

Key Economic Events & Data Releases (Today)

- (USD) S&P Global Manufacturing PMI (Apr)

- Forecast: 49.0 | Previous: 50.2 | Time: 19:15

- (USD) S&P Global Services PMI (Apr)

- Forecast: 52.8 | Previous: 54.4 | Time: 19:15

- (USD) New Home Sales (Mar)

- Forecast: 682K | Previous: 676K | Time: 19:30

- (GBP) BoE Governor Bailey Speech

- Time: 22:00