Global commodity markets are experiencing heightened volatility as escalating trade tensions and economic uncertainty drive price fluctuations. Gold and silver prices surge on safe-haven demand following U.S. President Donald Trump’s auto tariffs, while WTI crude oil gains amid Venezuelan supply concerns. Meanwhile, natural gas futures hover near key support levels as bearish weather forecasts weigh on market sentiment.

KEY HIGHLIGHTS

- Gold Gains as Trump’s Auto Tariffs Boost Safe-Haven Demand.

- Silver Holds Above $33.50 Amid Heightened Trade War Concerns.

- WTI Rises on Venezuela Supply Concerns, Near Four-Week High.

- Natural Gas Hovers Near Key Support Amid Bearish Weather.

Markets in Focus Today – Gold

Gold Prices Surge as Trump’s Auto Tariffs Rattle Markets

Gold prices climbed during Asian trading on Thursday, driven by increased safe-haven demand after President Donald Trump imposed a 25% tariff on all automobile imports. This move, set to take effect on April 2, has escalated trade tensions and triggered a broad sell-off in equities, pushing investors toward gold.

Despite minor profit-taking earlier this week, gold remains near record highs as concerns over U.S. trade and economic policies fuel demand for safe-haven assets. Investors now await key U.S. macroeconomic data and Federal Reserve commentary for further market direction.

Technical Overview

Moving Averages:

- Exponential:

- MA 10: 3011.36 | Bullish

- MA 20: 2980.45 | Bullish

- MA 50: 2899.94 | Bullish

- Simple:

- MA 10: 3022.10 | Bullish

- MA 20: 2967.59 | Bullish

- MA 50: 2893.94 | Bullish

Indicators:

- RSI: 67.49 | Bullish

- Stochastic Oscillator: 81.67 | Neutral

Resistance and Support Levels:

- R1: 2932.05 | R2: 2975.46

- S1: 2791.51 | S2: 2748.10

Market Sentiment: Bullish

Trade Suggestion: Limit Buy: 3027.00 | Take Profit: 3055.00 | Stop Loss: 3010.50

Silver

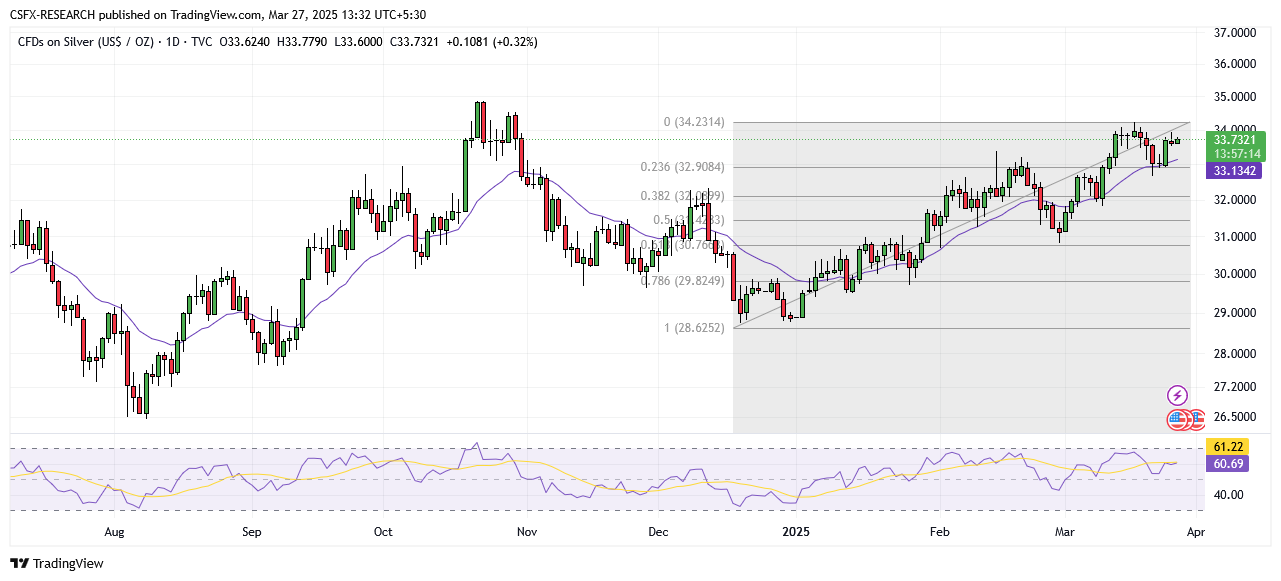

XAG/USD Holds Above $33.50, Boosted by Strong Safe-Haven Demand

Silver prices rebounded, trading near $33.70 per troy ounce during Thursday’s Asian session. The US auto tariff announcement has heightened concerns over potential retaliatory measures, deepening risk-off sentiment and driving investors toward silver. Additionally, declining US Treasury yields and a weaker dollar have strengthened silver’s appeal.

Technical Overview

Moving Averages:

- Exponential:

- MA 10: 33.58 | Bullish

- MA 20: 32.98 | Bullish

- MA 50: 31.25 | Bullish

- Simple:

- MA 10: 33.42 | Bullish

- MA 20: 33.10 | Bullish

- MA 50: 31.69 | Bullish

Indicators:

- RSI: 60.04 | Bullish

- Stochastic Oscillator: 51.39 | Neutral

Resistance and Support Levels:

- R1: 33.80 | R2: 34.50

- S1: 33.18 | S2: 32.27

Market Sentiment: Bullish

Trade Suggestion: Limit Buy: 33.48 | Take Profit: 33.95 | Stop Loss: 33.25

Crude Oil

WTI Rises Toward $69.50 Amid Venezuelan Supply Disruptions

West Texas Intermediate (WTI) crude oil climbed toward $69.40 in early Asian hours, extending its rally to a near four-week high. Trump’s newly imposed 25% secondary tariff on countries purchasing Venezuelan oil adds to global supply concerns. Additionally, U.S. crude inventories declined more than expected, further supporting prices.

However, a ceasefire agreement between Russia and Ukraine could ease supply constraints and limit crude oil’s upside momentum.

Technical Overview

Moving Averages:

- Exponential:

- MA 10: 68.63 | Bullish

- MA 20: 68.60 | Bullish

- MA 50: 69.77 | Bearish

- Simple:

- MA 10: 68.28 | Bullish

- MA 20: 67.79 | Bullish

- MA 50: 70.63 | Bearish

Indicators:

- RSI: 52.69 | Bullish

- Stochastic Oscillator: 34.09 | Neutral

Resistance and Support Levels:

- R1: 73.75 | R2: 75.36

- S1: 68.55 | S2: 66.94

Market Sentiment: Neutral

Trade Suggestion: Limit Sell: 69.54 | Take Profit: 68.54 | Stop Loss: 70.04

Natural Gas

Natural Gas Prices Hover Near Key Support Amid Bearish Weather Outlook

Natural gas futures trade near the $3.700 support level as traders anticipate either a breakout or a sharp decline. While U.S. production and LNG feed gas flows provide some support, mild weather conditions continue to weigh on demand. If natural gas falls below the 50-day moving average, further losses may be triggered.

Technical Overview

Moving Averages:

- Exponential:

- MA 10: 3.96 | Bearish

- MA 20: 4.03 | Bearish

- MA 50: 3.93 | Bearish

- Simple:

- MA 10: 3.99 | Bearish

- MA 20: 4.15 | Bearish

- MA 50: 3.95 | Bearish

Indicators:

- RSI: 39.87 | Neutral

- Stochastic Oscillator: 3.47 | Neutral

Resistance and Support Levels:

- R1: 4.36 | R2: 4.62

- S1: 3.53 | S2: 3.27

Market Sentiment: Bearish

Trade Suggestion: Limit Sell: 3.83 | Take Profit: 3.54 | Stop Loss: 4.04

Key Economic Events & Data Release Today:

- (USD) U.S. President Trump Speaks at 06:30

- (USD) GDP (QoQ) (Q4) Forecast: 2.3%, Previous: 3.1% at 18:00

- (USD) Initial Jobless Claims Forecast: 225K, Previous: 223K at 18:00