The commodity markets witnessed significant volatility this week, with macroeconomic factors driving price movements. Gold and silver retreated after reaching record highs, while oil and natural gas prices surged due to supply concerns. As investors shift focus to the Federal Reserve’s (Fed) upcoming policy decisions and key economic data releases, markets remain poised for further fluctuations.

KEY HIGHLIGHTS

- Gold Hits Record High as Traders React Post-Fed Decision.

- Silver Surges Amid Economic Uncertainty After Fed Policy Outcome.

- Crude Oil Climbs on Supply Concerns Despite Fed’s Caution.

- Natural Gas Gains Traction as Market Absorbs Fed’s Signals.

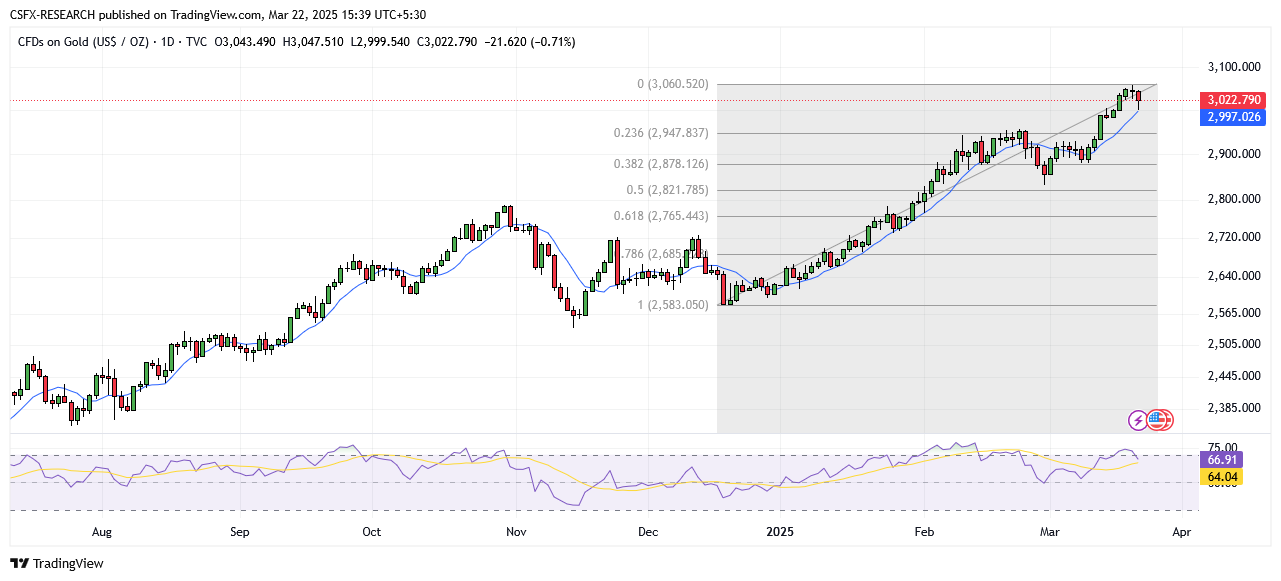

Gold Weekly Outlook: XAU/USD Prices Decline After Record Highs

Gold prices fell 1% this week after reaching new record highs, marking a second consecutive session of decline. Initially, concerns over a U.S. economic slowdown and rising global trade tensions boosted safe-haven demand. However, as the week progressed, gold came under bearish pressure, especially with renewed trade policy uncertainties under the Trump administration.

By midweek, Wall Street’s major indexes suffered steep losses, reinforcing demand for gold, which broke above its previous record of $2,956 and surpassed the $3,000 milestone. Additional support came from speculation that the People’s Bank of China (PBoC) may lower the reserve requirement ratio (RRR) by 25 to 50 basis points (bps).

Key Events to Watch

- Tuesday: U.S. Conference Board (CB) Consumer Confidence & New Home Sales data

- Wednesday: U.K. Consumer Price Index (CPI) & Annual Budget announcement

- Friday: U.S. Core Personal Consumption Expenditures (PCE) Price Index

Technical Overview

- Moving Averages (Exponential & Simple): Bullish

- RSI (Relative Strength Index): 67.18 | Buy Zone | Bullish

- Stochastic Oscillator: 90.48 | Buy Zone | Neutral

Resistance & Support Levels

- Resistance: R1: 2932.05 | R2: 2975.46

- Support: S1: 2791.51 | S2: 2748.10

Trade Suggestion:

Limit Buy: 2993.00 | Take Profit: 3060.50 | Stop Loss: 2956.62

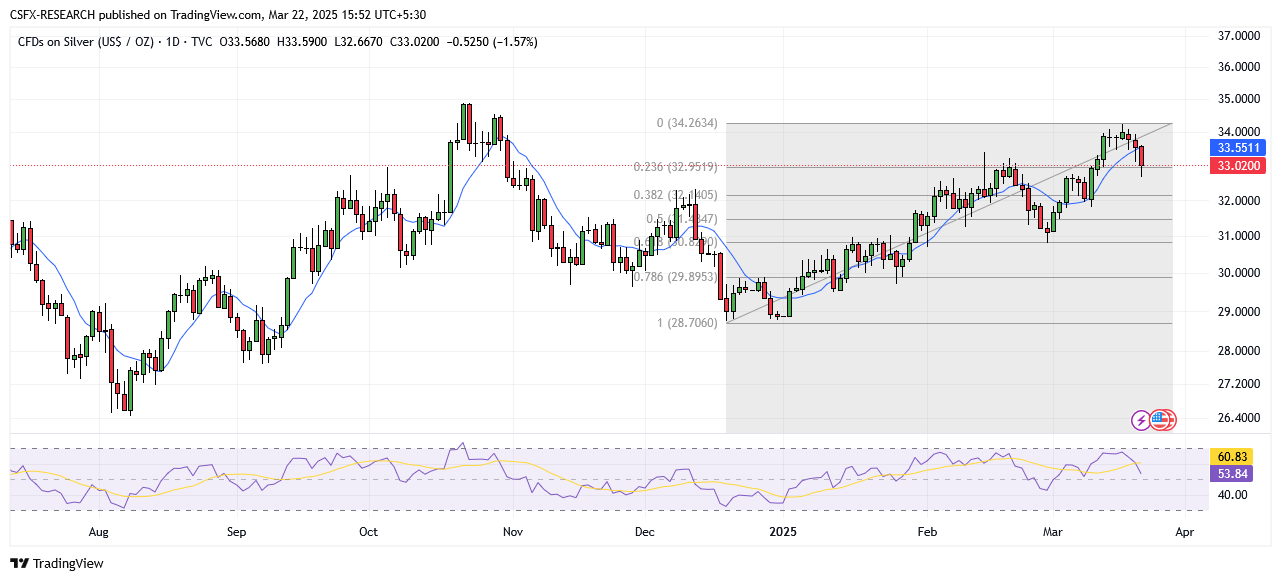

Silver Weekly Outlook: XAG/USD Faces Pressure Amid Fed’s Policy & Stronger U.S. Dollar

Silver prices retreated this week, pressured by a cautious Federal Reserve stance, a stronger U.S. dollar, and weak demand from China. Although silver initially benefited from gold’s surge, market sentiment shifted as the Fed signaled the need for greater confidence in inflation progress before cutting rates.

Key Events Impacting Silver

- The Fed’s decision to hold interest rates at 4.25%–4.50%

- A stronger U.S. dollar index rising 0.2%, making silver less attractive

- Uncertainty surrounding Chinese industrial demand

Technical Overview

- Moving Averages: Mixed signals

- RSI: 54.07 | Buy Zone | Bullish

- Stochastic Oscillator: 57.07 | Buy Zone | Neutral

Resistance & Support Levels

- Resistance: R1: 33.36 | R2: 34.17

- Support: S1: 32.60 | S2: 31.90

Trade Suggestion:

Limit Buy: 32.71 | Take Profit: 33.41 | Stop Loss: 32.28

Crude Oil Weekly Outlook: Prices Climb on Tightening Supply Concerns

Oil prices ended higher for the second straight week as U.S. sanctions on Iran and OPEC+ production strategies fueled expectations of tighter supply. Brent crude settled at $72.16 per barrel, while WTI closed at $68.28, marking their biggest weekly gains since January.

Key Market Drivers

- Federal Reserve’s interest rate outlook

- Energy Information Administration (EIA) inventory reports

- Global demand forecasts

Technical Overview

- Moving Averages: Bullish

- RSI: 48.00 | Neutral Zone | Neutral

- Stochastic Oscillator: 61.73 | Buy Zone | Neutral

Resistance & Support Levels

- Resistance: R1: 73.75 | R2: 75.35

- Support: S1: 68.54 | S2: 66.94

Trade Suggestion:

Limit Buy: 68.35 | Take Profit: 69.50 | Stop Loss: 67.77

Natural Gas Weekly Outlook: Prices Rebound on Supply Concerns

Natural gas futures recovered from a sharp selloff caused by an unexpected 9 Bcf storage injection. Despite weak heating demand and strong renewable energy output, colder weather forecasts and tightening supply expectations supported prices.

Key Factors Affecting Prices

- Fed’s interest rate decision

- Economic indicators and inflation data

- Geopolitical risks influencing energy markets

Technical Overview

- Moving Averages: Mixed signals

- RSI: 46.40 | Neutral Zone | Neutral

- Stochastic Oscillator: 18.39 | Sell Zone | Neutral

Resistance & Support Levels

- Resistance: R1: 4.36 | R2: 4.62

- Support: S1: 3.52 | S2: 3.26

Trade Suggestion:

Limit Sell: 4.05 | Take Profit: 3.84 | Stop Loss: 4.20

Commodity Market Overview: Price Movements & Economic Events

- Gold: Down (0.71%) at $3022.79

- Silver: Down (1.57%) at $33.02

- Palladium: Up (0.49%) at $954.33

- Platinum: Down (0.97%) at $977.32

- Brent Crude: Down (0.15%) at $72.13

- WTI Crude: Down (0.07%) at $68.31

Key Economic Events to Watch

- Tuesday: U.S. CB Consumer Confidence, New Home Sales

- Wednesday: U.K. CPI, Spring Budget Forecast

- Thursday: U.S. GDP (Q4), Initial Jobless Claims

- Friday: U.S. Core PCE Price Index (YoY & MoM)

Conclusion

The commodities market remains highly volatile, driven by macroeconomic data, Federal Reserve policies, and geopolitical risks. Traders should closely monitor key economic indicators, Fed policy statements, and supply-demand fundamentals to navigate potential price movements effectively.