The commodity markets, including gold, silver, crude oil, and natural gas, are experiencing significant price movements due to geopolitical tensions, economic uncertainty, and policy shifts. Gold and silver are extending gains on safe-haven demand, while crude oil is climbing due to concerns in the Middle East and optimism about China’s economy. Meanwhile, natural gas futures are rising but face resistance due to mild weather conditions.

KEY HIGHLIGHTS

- Gold Hits Record High on Safe-Haven Demand Surge.

- Silver Nears $34 Amid Middle East Tensions, Demand.

- WTI Crude Climbs Above $68 On Geopolitical Concerns.

- Natural Gas Gains, But Warm Weather Limits Upside.

Gold (XAU/USD) Analysis

Gold Prices Hit Record High on Safe-Haven Demand

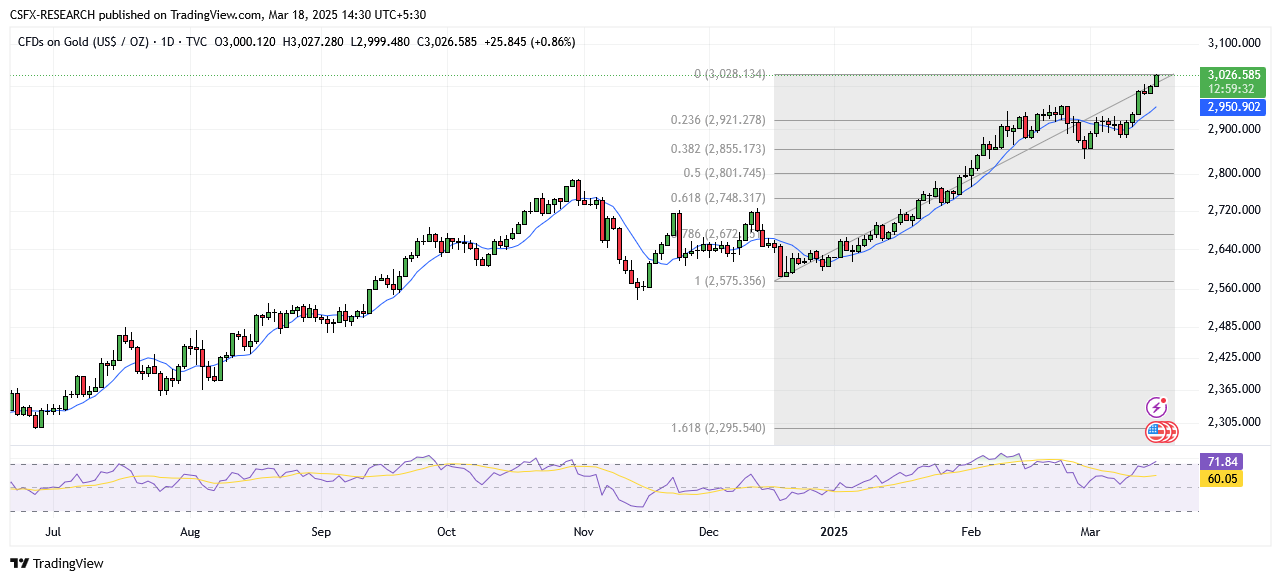

Gold prices continue their upward momentum, reaching a fresh all-time high near $3,019. The surge is driven by uncertainty surrounding U.S. policies, recession concerns, and escalating geopolitical risks. Expectations of multiple Federal Reserve (Fed) rate cuts this year further fuel the rally.

Key Market Drivers:

- Safe-haven demand due to global uncertainties.

- Optimism surrounding China’s economic stimulus.

- Potential rate cuts from the Federal Reserve.

- A modest recovery in the U.S. Dollar (USD) may limit further upside.

Technical Overview:

- Exponential Moving Averages:

- MA 10: 2961.75 | Bullish

- MA 20: 2931.68 | Bullish

- MA 50: 2858.11 | Bullish

- Relative Strength Index (RSI): 71.91 (Buy Zone)

- Stochastic Oscillator: 94.99 (Neutral)

Support and Resistance Levels:

- Resistance: R1: 2932.05, R2: 2975.46

- Support: S1: 2791.51, S2: 2748.10

Trade Suggestion:

- Limit Buy: 2976.00

- Take Profit: 3030.50

- Stop Loss: 2944.03

Silver (XAG/USD) Analysis

Silver Gains Traction on Economic Uncertainty and Industrial Demand

Silver prices extend their rally, reaching $33.90, the highest level since October 2024. The metal is supported by a weaker USD, rising geopolitical tensions, and increasing industrial demand.

Key Market Drivers:

- Geopolitical risks in the Middle East.

- Industrial demand from photovoltaic applications, 5G technology, and automotive electronics.

- Trade policy uncertainties in the U.S.

Technical Overview:

- Exponential Moving Averages:

- MA 10: 33.22 | Bullish

- MA 20: 32.73 | Bullish

- MA 50: 31.40 | Bullish

- Relative Strength Index (RSI): 69.03 (Buy Zone)

- Stochastic Oscillator: 99.08 (Positive)

Support and Resistance Levels:

- Resistance: R1: 34.26, R2: 34.76

- Support: S1: 33.35, S2: 32.65

Trade Suggestion:

- Limit Buy: 33.38

- Take Profit: 34.45

- Stop Loss: 32.76

Crude Oil (WTI) Analysis

WTI Climbs to Two-Week High on Middle East Tensions and China Optimism

WTI crude oil prices extend gains, reaching a two-week high above $68.00. The price increase is driven by escalating tensions in the Middle East and optimism about China’s economic stimulus measures.

Key Market Drivers:

- U.S. President’s stance on Yemen’s Houthi attacks.

- Israeli military operations in Gaza heighten geopolitical risks.

- China’s stimulus plans supporting oil demand.

Technical Overview:

- Exponential Moving Averages:

- MA 10: 67.59 | Bullish

- MA 20: 68.42 | Bearish

- MA 50: 70.13 | Bearish

- Relative Strength Index (RSI): 46.94 (Neutral Zone)

- Stochastic Oscillator: 44.03 (Neutral)

Support and Resistance Levels:

- Resistance: R1: 73.75, R2: 75.36

- Support: S1: 68.55, S2: 66.94

Trade Suggestion:

- Limit Sell: 69.13

- Take Profit: 67.22

- Stop Loss: 70.48

Natural Gas (NG) Analysis

Natural Gas Futures Surge, but Warm Weather Limits Gains

Natural gas prices start the week on a positive note but face resistance at $4.322 due to mild weather conditions, reducing heating demand.

Key Market Drivers:

- Inventories 11.9% below the five-year average.

- Warmer forecasts limiting upside potential.

- Lack of strong LNG flows or supply disruptions keeps sentiment cautious.

Technical Overview:

- Exponential Moving Averages:

- MA 10: 4.17 | Bearish

- MA 20: 4.15 | Bearish

- MA 50: 3.93 | Bullish

- Relative Strength Index (RSI): 56.00 (Buy Zone)

- Stochastic Oscillator: 19.03 (Neutral)

Support and Resistance Levels:

- Resistance: R1: 4.36, R2: 4.62

- Support: S1: 3.53, S2: 3.27

Trade Suggestion:

- Limit Buy: 3.89

- Take Profit: 4.33

- Stop Loss: 3.69

Commodity Market Overview

- Gold up (0.87%) at $3026.87

- Silver up (0.74%) at $34.06

- Palladium up (1.01%) at $977.81

- Platinum up (0.01%) at $994.40

- Brent Crude Oil up (1.31%) at $71.83

- WTI Crude Oil up (1.33%) at $68.35

Key Economic Events & Data Releases

- (CAD) Core CPI (MoM) (Feb): Previous 0.4% (Expected at 18:00)

- (CAD) Core CPI (YoY) (Feb): Previous 2.1% (Expected at 18:00)

- (USD) Industrial Production (YoY) (Feb): Previous 2.00% (Expected at 18:45)

Conclusion

The commodity market remains highly volatile amid global uncertainties. Traders should monitor key economic data, geopolitical events, and central bank policies to navigate price movements effectively.