The foreign exchange market witnessed significant movements this week as major currency pairs reacted to evolving economic and geopolitical factors. The US Dollar (USD) rebounded amid the Federal Reserve’s cautious stance on rate cuts, while geopolitical tensions and economic data influenced the Euro (EUR), Pound Sterling (GBP), Japanese Yen (JPY), and Australian Dollar (AUD). Looking ahead, key inflation reports and central bank commentary will shape market sentiment.

KEY HIGHLIGHTS

- EUR/USD Retreats as Dollar Gains on Fed Caution.

- Pound Weakens Amid Geopolitical Tensions and Economic Uncertainty.

- USD/JPY Nears 150 as Yen Struggles Against Dollar.

- AUD/USD Drops as Fed Holds Cautious Policy Stance.

EUR/USD Weekly Outlook: Dollar Rebounds Amid Fed Caution

The EUR/USD pair retreated after reaching a multi-month high of 1.0954, ultimately settling near the 1.0800 level. The US Dollar strengthened following the Federal Reserve’s monetary policy announcement. While the USD fluctuated post-announcement, it surged due to persistent trade-war concerns and extreme oversold conditions triggering profit-taking.

Market Influences & Upcoming Data

- The Fed maintained interest rates within the 4.25%–4.50% range and reaffirmed its outlook for two rate cuts in 2025.

- Positive German economic headlines supported the Euro earlier in the week.

- The upcoming macroeconomic calendar includes preliminary March Purchasing Managers’ Index (PMI) data from the Hamburg Commercial Bank (HCOB) and S&P Global.

- Key US releases: Q4 GDP estimate (expected at 2.3% growth), February Durable Goods Orders, and the PCE Price Index.

Technical Overview

- Moving Averages:

- Exponential: MA 10 – 1.0840 (Bearish), MA 20 – 1.0754 (Bullish), MA 50 – 1.0615 (Bullish)

- Simple: MA 10 – 1.0879 (Bearish), MA 20 – 1.0727 (Bullish), MA 50 – 1.0526 (Bullish)

- RSI: 59.23 (Buy Zone, Bullish)

- Stochastic Oscillator: 81.49 (Neutral)

- Key Levels:

- Resistance: R1 – 1.0493, R2 – 1.0568

- Support: S1 – 1.0249, S2 – 1.0174

- Trade Suggestion: Limit Buy @ 1.0709 | Take Profit @ 1.0930 | Stop Loss @ 1.0599

GBP/USD Weekly Outlook: Pound Sterling Retreats Amid Uncertainty

The GBP/USD pair retreated after approaching the 1.3000 level, though it remains near a four-month high. Escalating geopolitical tensions in the Middle East, coupled with US trade policies, added to market uncertainty. The USD initially struggled due to recession fears but later rebounded following the Fed’s cautious stance on rate cuts.

Market Influences & Upcoming Data

- The UK will release its CPI report and the Annual Budget on Wednesday.

- The US will publish CB Consumer Confidence, New Home Sales, Durable Goods Orders, and the Core PCE Price Index.

Technical Overview

- Moving Averages:

- Exponential: MA 10 – 1.2932 (Bearish), MA 20 – 1.2852 (Bullish), MA 50 – 1.2710 (Bullish)

- Simple: MA 10 – 1.2953 (Bearish), MA 20 – 1.2842 (Bullish), MA 50 – 1.2593 (Bullish)

- RSI: 60.52 (Buy Zone, Bullish)

- Stochastic Oscillator: 85.56 (Neutral)

- Key Levels:

- Resistance: R1 – 1.2691, R2 – 1.2801

- Support: S1 – 1.2335, S2 – 1.2225

- Trade Suggestion: Limit Buy @ 1.2807 | Take Profit @ 1.3019 | Stop Loss @ 1.2707

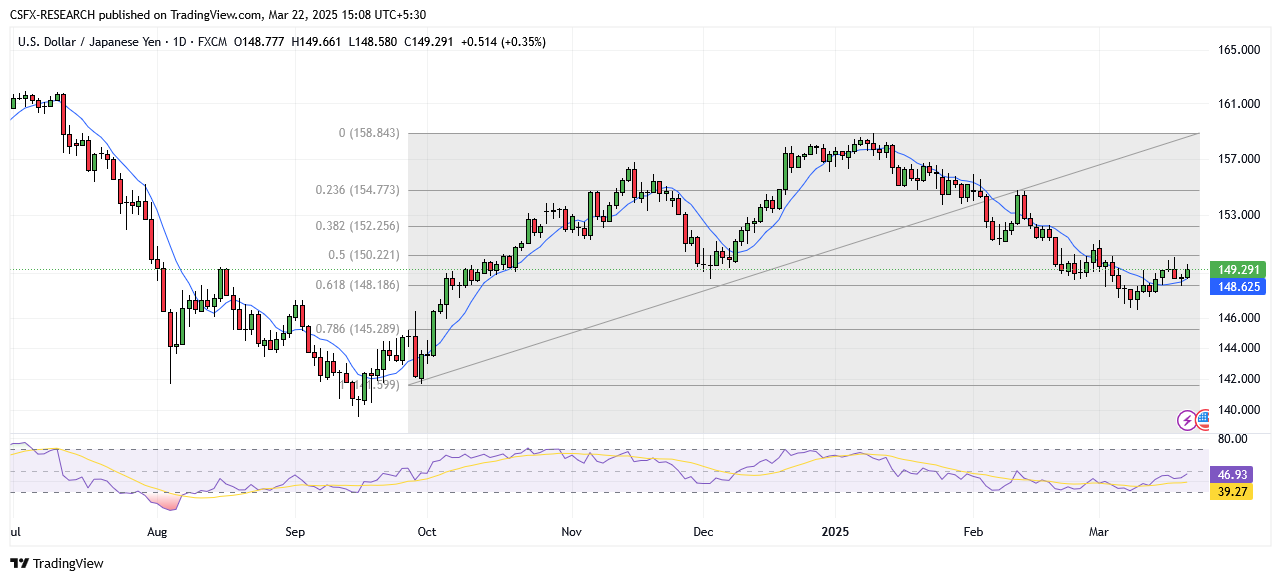

USD/JPY Weekly Outlook: Yen Weakens Amid Fed Policy Divergence

USD/JPY maintained its upward trajectory, nearing the 150.00 mark as the USD remained strong due to the Fed’s cautious approach to rate cuts. Meanwhile, the Japanese Yen (JPY) struggled due to ongoing policy divergence between the Bank of Japan (BoJ) and the Fed.

Market Influences & Upcoming Data

- Fed Chair Powell emphasized no rush for rate cuts, strengthening the USD.

- Japan’s CPI data, due Friday, could impact the BoJ’s stance on monetary policy.

Technical Overview

- Moving Averages:

- Exponential: MA 10 – 148.82 (Bullish), MA 20 – 149.25 (Bullish), MA 50 – 150.97 (Bearish)

- Simple: MA 10 – 148.46 (Bullish), MA 20 – 148.82 (Bullish), MA 50 – 151.91 (Bearish)

- RSI: 46.85 (Neutral)

- Stochastic Oscillator: 56.15 (Neutral)

- Key Levels:

- Resistance: R1 – 154.47, R2 – 156.20

- Support: S1 – 148.88, S2 – 147.15

- Trade Suggestion: Limit Sell @ 149.70 | Take Profit @ 148.09 | Stop Loss @ 150.97

AUD/USD Weekly Outlook: Aussie Struggles Amid Risk-Off Sentiment

The AUD/USD pair faced downward pressure as the USD remained strong, driven by the Fed’s cautious stance. Risk-sensitive assets like the Australian Dollar struggled due to weaker consumer sentiment and concerns over China’s economic outlook.

Market Influences & Upcoming Data

- Australian employment data showed resilience, but weak consumer sentiment weighed on the AUD.

- The US will release Q4 GDP and the PCE Price Index this week.

Technical Overview

- Moving Averages:

- Exponential: MA 10 – 0.6313 (Bearish), MA 20 – 0.6309 (Bearish), MA 50 – 0.6308 (Bearish)

- Simple: MA 10 – 0.6315 (Bearish), MA 20 – 0.6302 (Bearish), MA 50 – 0.6285 (Bearish)

- RSI: 45.26 (Neutral)

- Stochastic Oscillator: 59.13 (Neutral)

- Key Levels:

- Resistance: R1 – 0.6356, R2 – 0.6431

- Support: S1 – 0.6111, S2 – 0.6035

- Trade Suggestion: Limit Sell @ 0.6317 | Take Profit @ 0.6255 | Stop Loss @ 0.6364

Elsewhere in the Forex Market

- NZD/USD down 0.44% to 0.5732.

- USD/CAD up 0.22% to 1.4354.

- USD/CHF up 0.16% at 0.8831.

- EUR/GBP up 0.04% at 0.8373.

- USD/CNY down 0.01% at 7.2485.

Key Economic Events This Week

- (USD) CB Consumer Confidence (Mar)

- (GBP) CPI (YoY) (Feb)

- (USD) GDP (QoQ) (Q4)

- (USD) Core PCE Price Index (MoM) (Feb)