Major currency pairs are exhibiting mixed movement during Friday’s trading, with diverging trends seen across the board. This is largely influenced by recent central bank actions, key economic data, and evolving trade negotiations. The US Dollar continues to show strength, backed by positive domestic indicators and global trade sentiment. In this report, we analyze EUR/USD, GBP/USD, USD/JPY, and AUD/USD, with tailored insights for traders in the US and UK.

KEY HIGHLIGHTS

- EUR/USD rebounds as Dollar strength limits further upside momentum.

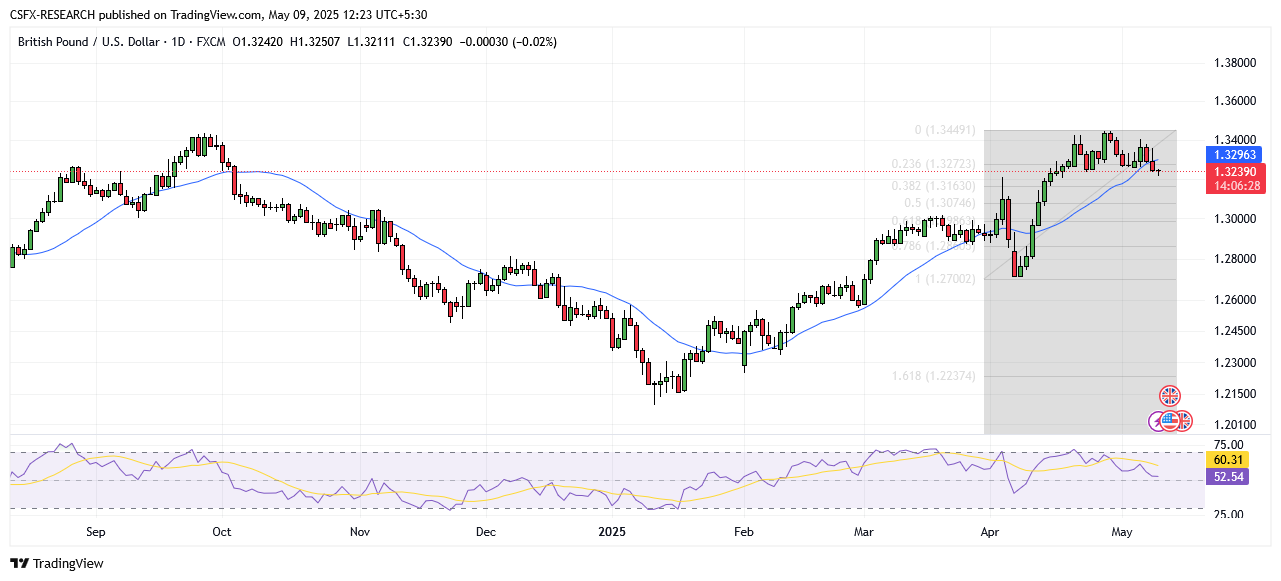

- GBP/USD weakens below 1.3250 amid BoE rate cut.

- USD/JPY dips slightly, Yen supported by Japan’s strong data.

- AUD/USD steadies near 0.6400 after upbeat Chinese trade report.

EUR/USD: Rebounds Above 1.1200 but Downside Risks Remain

Market Overview

During Friday’s Asian session, EUR/USD climbed back above the 1.1200 level, trading around 1.1230. This rebound follows early weakness triggered by renewed US Dollar strength, supported by stronger-than-expected US jobless claims data and easing trade tensions.

- US Data: Initial jobless claims for the week ending May 3 fell to 228,000, better than forecast. Continuing claims also declined.

- Trade Developments: A new US-UK trade deal was announced, though tariff concerns linger.

- ECB Outlook: The Euro faces pressure from expectations of further European Central Bank rate cuts, possibly by June.

Technical Overview

Moving Averages

- Exponential:

- MA 10: 1.1299 – Bearish

- MA 20: 1.1271 – Bearish

- MA 50: 1.1079 – Bullish

- Simple:

- MA 10: 1.1318 – Bearish

- MA 20: 1.1346 – Bearish

- MA 50: 1.1059 – Bullish

Indicators

- RSI: 51.19 – Bullish zone

- Stochastic Oscillator: 10.65 – Neutral to sell zone

Key Levels

- Resistance: R1 1.1530, R2 1.1718

- Support: S1 1.0923, S2 1.0735

Overall Sentiment: Bullish

Market Direction: Buy

Trade Suggestion: Limit Buy at 1.1182 | Take Profit at 1.1319 | Stop Loss at 1.1110

GBP/USD: Under Pressure Despite BoE Rate Cut

Market Overview

GBP/USD remains weak under the 1.3250 level during Friday’s European session. Despite the Bank of England’s 25 basis point rate cut to 4.25%, the Pound continues to face downward pressure.

- BoE Policy Split: Vote split highlights uncertainty. Five members voted for a 25 bps cut, while others diverged.

- Trade Sentiment: A new US-UK trade agreement has limited impact, as the US Dollar remains strong.

- US Dollar Influence: Supported by stable Fed policy and economic resilience, the greenback overshadows Sterling.

Technical Overview

Moving Averages

- Exponential:

- MA 10: 1.3284 – Bearish

- MA 20: 1.3244 – Bearish

- MA 50: 1.3076 – Bullish

- Simple:

- MA 10: 1.3314 – Bearish

- MA 20: 1.3296 – Bearish

- MA 50: 1.3069 – Bullish

Indicators

- RSI: 52.57 – Bullish zone

- Stochastic Oscillator: 15.45 – Neutral to sell zone

Key Levels

- Resistance: R1 1.3439, R2 1.3613

- Support: S1 1.2878, S2 1.2704

Overall Sentiment: Bullish

Market Direction: Buy

Trade Suggestion: Limit Buy at 1.3177 | Take Profit at 1.3366 | Stop Loss at 1.3071

USD/JPY: Modest Recovery for Yen but Limited Upside

Market Overview

USD/JPY sees limited downside as the Japanese Yen recovers slightly after hitting a four-week low. The pair trades lower near 145.39 in early US trading.

- Japan Data: Strong household spending raises expectations of further BoJ tightening.

- Safe-Haven Appeal: Geopolitical tensions support the Yen.

- Fed Policy: The Fed’s hawkish pause limits any sustained USD pullback.

Technical Overview

Moving Averages

- Exponential:

- MA 10: 144.17 – Bullish

- MA 20: 144.23 – Bullish

- MA 50: 146.15 – Bearish

- Simple:

- MA 10: 143.86 – Bullish

- MA 20: 143.19 – Bullish

- MA 50: 146.29 – Bearish

Indicators

- RSI: 52.52 – Bullish zone

- Stochastic Oscillator: 82.06 – Bullish zone

Key Levels

- Resistance: R1 148.49, R2 150.99

- Support: S1 140.39, S2 137.88

Overall Sentiment: Bearish

Market Direction: Sell

Trade Suggestion: Limit Sell at 146.17 | Take Profit at 143.93 | Stop Loss at 147.84

AUD/USD: Holds Near 0.6400 Amid China Data

Market Overview

AUD/USD is holding near the 0.6400 level after a modest rebound supported by positive Chinese trade data. However, concerns over slow US-China negotiations continue to pressure the Aussie.

- China Trade Data: April’s surplus at $96.18 billion, with stronger-than-expected exports.

- Policy Changes: China may implement property market reforms to stabilize economic outlook.

- US-China Tensions: US rhetoric under Trump administration remains cautious.

Technical Overview

Moving Averages

- Exponential:

- MA 10: 0.6413 – Bearish

- MA 20: 0.6384 – Bullish

- MA 50: 0.6339 – Bullish

- Simple:

- MA 10: 0.6421 – Bearish

- MA 20: 0.6397 – Bullish

- MA 50: 0.6315 – Bullish

Indicators

- RSI: 53.42 – Bullish zone

- Stochastic Oscillator: 37.37 – Neutral to sell zone

Key Levels

- Resistance: R1 0.6459, R2 0.6585

- Support: S1 0.6050, S2 0.5924

Overall Sentiment: Bullish

Market Direction: Buy

Trade Suggestion: Limit Buy at 0.6354 | Take Profit at 0.6495 | Stop Loss at 0.6283

Elsewhere in the Forex Market

- USD/CAD up 0.2% to 1.3926

- USD/JPY down 0.35% to 145.39

- EUR/GBP slightly up at 0.8485

- EUR/AUD up 0.13% at 1.7565

- AUD/NZD up 0.22% at 1.0861

- USD/CNY up 0.16% at 7.2451

- AUD/SEK down 0.34% at 6.2091

Key Economic Events Today (Local Relevance)

- UK: No major data, but GBP remains sensitive to trade headlines.

- US (ET):

- (18:00) CAD Unemployment Rate – Forecast: 6.8%, Previous: 6.7%

- (21:00) Fed Waller Speaks – May influence USD sentiment