Despite positive Q4 numbers, Tesla shares have corrected by over 15% within 30 days.

FUNDAMENTAL OVERVIEW:

Despite a positive performance in the October-December period (Q4), shares of the electric vehicle (EV) leader Tesla have declined by over 15% in the past 30 days. During the quarter, the company’s services segment witnessed a sequential growth of 37%, while the energy and storage segment surged by 54%.

As per the analyst’s assessment, Tesla’s year-on-year profits for 2023 have decreased by 23%, attributing it as a significant factor behind the stock’s underperformance. These disappointing figures are also believed to have influenced overall earnings and per-vehicle profitability.

Tesla’s Q4 performance and net income saw a significant increase last quarter, largely due to a substantial one-time tax benefit. However, the company cautioned about “notably lower” sales growth for the current year. Tesla, headquartered in Texas, reported a net income of $7.93 billion from October to December, a considerable rise from $3.69 billion in the previous year.

Tesla disclosed quarterly revenue of $25.17 billion, marking a three percent increase compared to the previous year, albeit falling short of Wall Street’s projections. The company’s profits declined as Tesla implemented price reductions globally throughout the year to enhance its sales and market presence.

In the fourth quarter, Tesla experienced nearly a 20 percent increase in sales, driven by substantial price reductions in the US and globally throughout the year. Official data indicates that certain reductions reached up to $20,000 on higher-priced models.

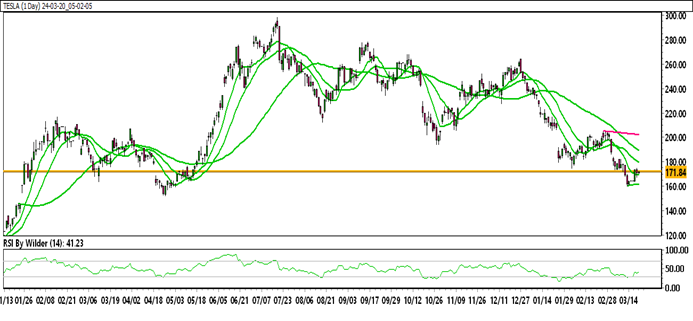

TESLA TECHNICAL ANALYSIS DAILY CHART:

Technical Overview:

Tesla is trading within a down channel.

Tesla is positioned below the 20&50 Moving Average (SMA).

The Relative Strength Index (RSI) is in a Neutral zone, while the Stochastic oscillator suggests a Negative trend.

Immediate Resistance level: 174.20

Immediate support level: 159.88

HOW TO TRADE TESLA

After a significant rise, Tesla’s stock declined and entered a downward channel, forming lower lows. Presently, Tesla is retracing upwards and approaching a strong resistance zone. If it faces rejection at this level, it may continue its downward trajectory.