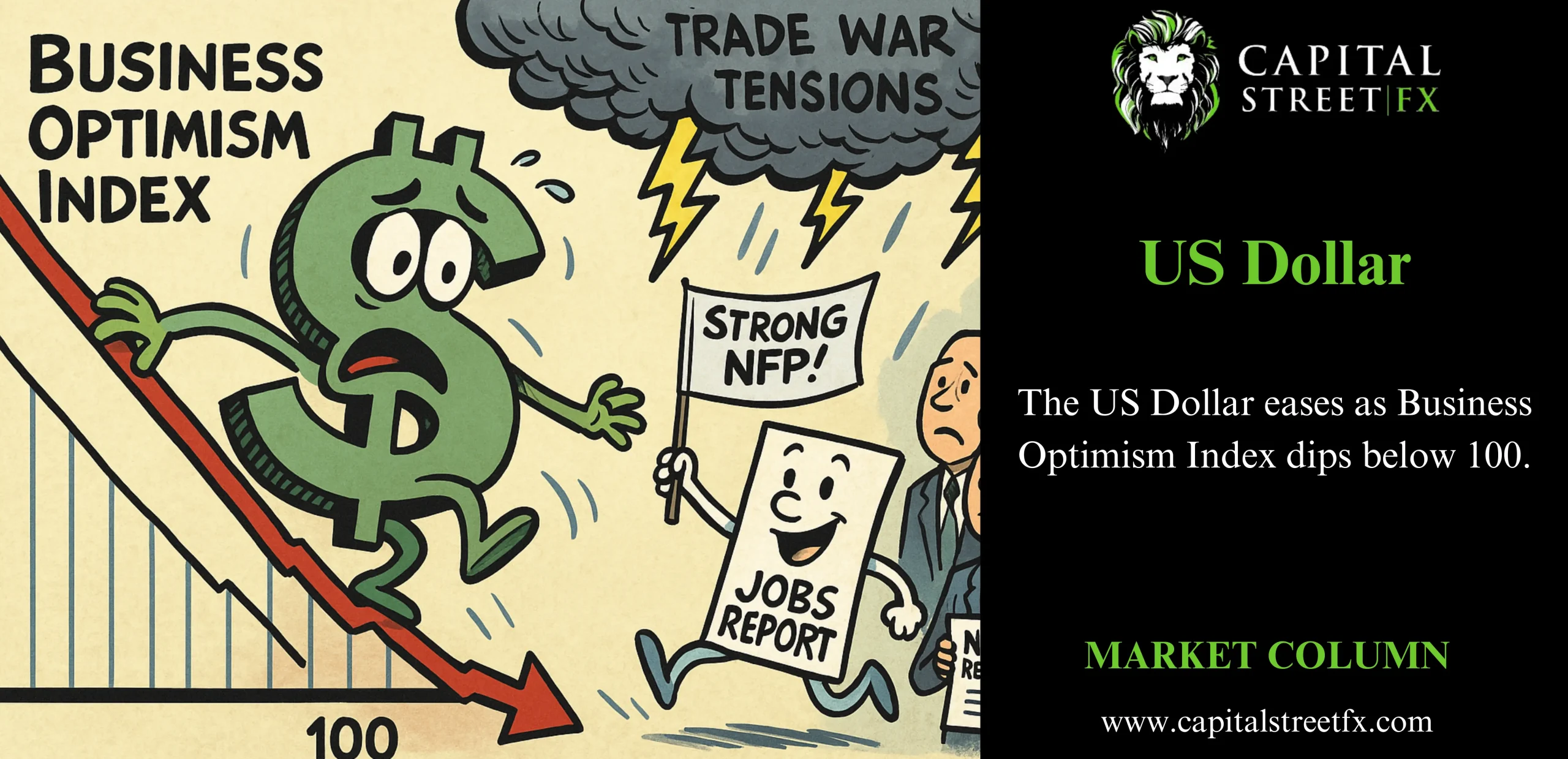

The US Dollar eases as Business Optimism Index dips below 100.

- The US Dollar slips on Tuesday against major currencies amid escalating trade war tensions.

- However, upbeat Nonfarm Payrolls data and a rebound in US Treasury yields prompted markets to reassess the Greenback positively.

- The US Dollar Index has climbed back above 103.00, aiming to stabilize further.

The US Dollar Index (DXY), which measures the USD against six major currencies, is hovering near the 103.00 level on Tuesday, following remarks from Secretary Scott Bessent. While recent risk-off sentiment had weighed on the Greenback, Friday’s strong Nonfarm Payrolls (NFP) report helped spark a rebound. The focus now shifts to whether this recovery can hold as more U.S. economic data is released.

On the data front, markets await the National Federation of Independent Business (NFIB) Business Optimism Index for March. With ongoing tariff tensions, this report could offer early insights into how U.S. businesses are reacting to the shifting trade landscape.

Meanwhile, Secretary Bessent noted that 70 countries have already initiated talks with the U.S., with President Trump set to be directly involved in each negotiation. Priority will be given to nations that refrained from escalating the trade conflict. In Europe, European Commission President Ursula von der Leyen expressed willingness to engage in dialogue over U.S. import tariffs but reaffirmed the EU’s readiness to respond with countermeasures if needed.