Introduction

In the competitive world of online forex and CFD trading, brokers strive to differentiate themselves with unique incentives, especially through bonuses. Among these, tradable bonuses and non-tradable bonuses have become key marketing and retention tools. For experienced traders, understanding the fine line between these two types of bonuses is vital, not only for maximizing capital efficiency but also for navigating regulatory compliance and risk exposure.

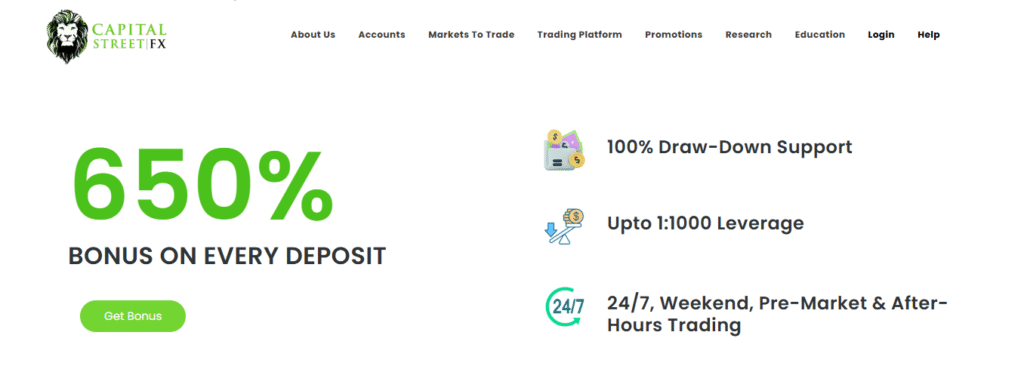

This blog explores the concept of a tradable bonus, how it differs from a non-tradable bonus, and why many seasoned traders are gravitating toward brokers that offer flexible, equity-enhancing bonus structures. Special focus will be given to Capital Street FX, which is leading the industry in offering real-time tradable bonuses, and how it compares to other brokers such as Exness, FXPro, IC Markets, Capital.com, FXCM, and ATFX.

What Is a Tradable Bonus?

A tradable bonus is a type of trading incentive credited to a trader’s live account that can be used as real margin. Unlike non-tradable bonuses, a tradable bonus enhances the equity and margin availability of the account, giving the trader more leverage and the ability to open larger positions.

Tradable bonuses can be withdrawn in specific conditions, such as after reaching a particular trading volume or retention period. They work like risk capital, improving account performance without exposing the trader to immediate debt or capital loss.

READ MORE – 650% Forex Bonus – Highest Deposit & Best Tradable Bonus |

Benefits of Tradable Bonuses

- Boosts account equity and margin

- Allows traders to take larger positions

- Can absorb drawdowns during high volatility

- May become withdrawable after meeting trading requirements

What Is a Non-Tradable Bonus?

A non-tradable bonus is a promotional credit given by brokers that does not count toward account equity. It cannot be used to open new positions and serves primarily as a marketing tool to encourage deposit activity.

These bonuses are usually removed upon withdrawal or once certain conditions are triggered. In many cases, traders cannot use them to mitigate losses or expand trading scope.

Drawbacks of Non-Tradable Bonuses

- Doesn’t enhance equity or usable margin

- Gets removed if a withdrawal is made

- Offers no real utility in live market trading

- Often tied to misleading terms and conditions

Key Differences Between Tradable and Non-Tradable Bonuses

| Feature | Tradable Bonus | Non-Tradable Bonus |

|---|---|---|

| Usable Margin | Yes | No |

| Counts as Equity | Yes | No |

| Withdrawable | Under conditions | Usually No |

| Risk Coverage | Can absorb drawdown | Cannot absorb losses |

| Purpose | For trading & growth | For acquisition & promotion |

Why Experienced Traders Choose Tradable Bonuses

Experienced traders understand the mechanics of leverage, margin calls, and equity drawdowns. They opt for bonuses that extend their operational capacity, not just superficial credits. A tradable bonus directly enhances a trader’s risk-adjusted return strategy and supports better margin utilization, especially during news-driven volatility.

Read More – High Leverage Brokers for Forex & CFD | Up to 1:10000

Capital Street FX: Leading the Way in Tradable Bonuses

1. Bonus Structure

Capital Street FX offers 100% tradable bonuses on deposits with no cap on earnings potential. The bonus is credited instantly and is used as live equity, allowing traders to use the full margin for strategic trades.

2. Transparency and Terms

Unlike many competitors, Capital Street FX outlines clear bonus terms—with well-defined withdrawal conditions based on trading volume. There’s no bait-and-switch, and no cancellation upon withdrawal, which is common with other brokers.

3. Margin & Risk Utility

Capital Street FX’s tradable bonus can absorb drawdowns, offering traders more flexibility in risky market phases. The bonus remains active and usable even during floating losses.

4. Regulatory Clarity

Capital Street FX is known for its transparent compliance framework, clearly separating bonus capital from client funds for audit and regulatory purposes.

Competitor Comparison: Capital Street FX vs Other Brokers

1. Exness

- Bonus Type: No traditional bonuses; focus is on low spreads and high leverage

- Drawback: No tradable bonuses available

- Trader Sentiment: High trust, but lacks capital incentives for aggressive strategies

Capital Street FX Advantage: Offers bonus capital for margin expansion, unlike Exness.

2. FXPro

- Bonus Type: Non-tradable welcome bonuses (time-limited)

- Usability: Cannot be used for margin or drawdown

- Drawback: Marketing-oriented bonus structure, little trading value

Capital Street FX Advantage: Long-term utility of tradable bonus; not just a lead-generation tool.

Read More – U.S. Private Sector Payrolls Exceed Expectations in January 2025

3. IC Markets

- Bonus Type: No bonuses; focus is on institutional-grade execution

- Drawback: Not suitable for retail traders looking for capital leverage

Capital Street FX Advantage: Supports retail traders with robust tradable bonuses to compete with larger players.

4. Capital.com

- Bonus Type: No bonuses offered; follows strict EU compliance

- Drawback: Rigid approach to incentives; limited client acquisition flexibility

Capital Street FX Advantage: Offshore yet compliant structure allows it to offer flexible bonuses without compromising client protection.

5. FXCM

- Bonus Type: Time-sensitive promotions; mostly non-tradable

- Issues: Strict withdrawal restrictions on bonus accounts

Capital Street FX Advantage: No gimmicks—bonus remains in account during withdrawals and doesn’t reset equity.

6. ATFX

- Bonus Type: Occasionally offers bonuses, but mostly non-tradable

- Drawback: Difficult to convert into usable equity

Capital Street FX Advantage: Bonus is fully usable from day one, with conditions clearly outlined.

Why Capital Street FX Is the Superior Choice

| Feature | Capital Street FX | Others (e.g., Exness, IC Markets) |

|---|---|---|

| Type of Bonus Offered | Tradable | Mostly non-tradable or none |

| Bonus Utility | Live Equity | Restricted or promotional use |

| Margin Impact | High | Low to None |

| Transparency of Terms | High | Often vague or hidden |

| Withdrawal Flexibility | Yes | Conditional or restrictive |

| Regulation + Bonus Capability | Balanced | Either overregulated or bonus-free |

How to Use a Tradable Bonus Effectively

- Leverage for Swing Trading

Use the bonus to scale up your position sizes responsibly. - Cover High Volatility Drawdowns

Bonuses act as a cushion when markets turn unexpectedly. - Meet Volume Milestones

Convert bonus to withdrawable funds by trading consistently. - Diversify Positions

More capital means more instruments to trade simultaneously.

FAQs

1. What is a tradable bonus in forex trading?

A tradable bonus is credit given by brokers that can be used as live equity and margin. It can absorb drawdowns and enhance position sizes.

2. Can I withdraw a tradable bonus?

Yes, in most cases, once trading volume requirements are met, tradable bonuses become withdrawable.

3. How does Capital Street FX’s tradable bonus differ from other brokers?

Unlike many brokers offering non-tradable or promotional bonuses, Capital Street FX offers a fully tradable bonus usable for margin and equity growth.

4. Is using a bonus in forex safe?

Yes, if the broker is regulated and transparent. Avoid bonuses with hidden conditions or cancellation clauses.

5. Which forex broker gives the best tradable bonus in 2025?

Capital Street FX currently leads the market with its 100% tradable, flexible, and withdrawable bonus model tailored for active and experienced traders.

Conclusion

For the experienced trader, bonus capital is more than a marketing tool—it’s a strategic resource. A tradable bonus boosts equity, enhances trade capacity, and reduces the impact of short-term volatility. Capital Street FX has emerged as the top choice for serious traders seeking meaningful incentives that go beyond flashy promotions.

In comparison to Exness, FXPro, IC Markets, Capital.com, FXCM, and ATFX, Capital Street FX stands out by offering real, usable, and transparent tradable bonuses. This makes it the preferred platform for professionals looking to gain an edge in global markets.