US DOLLAR, EURO, BRITISH POUND VS JAPANESE YEN.

The upcoming release of US Consumer Price Index (CPI) data later today is anticipated to shed light on whether the recent rebound in the Japanese yen is merely a temporary correction or the beginning of a sustained upward trend against some of its major counterparts.

From a monetary policy standpoint, market expectations suggest that the US Federal Reserve will likely implement a 75 basis point (bps) interest rate cut by the end of the year. This projection follows the US central bank’s indication of a pause in its tightening cycle last week. Anticipated easing measures by the Federal Reserve could potentially limit the upside potential for the USD/JPY currency pair. Meanwhile, the Bank of Japan (BOJ) maintained its ultra-loose policy settings last month. However, with Japan’s inflation surpassing the BOJ’s target, it may only be a matter of time before the Japanese central bank adjusts its policy stance.

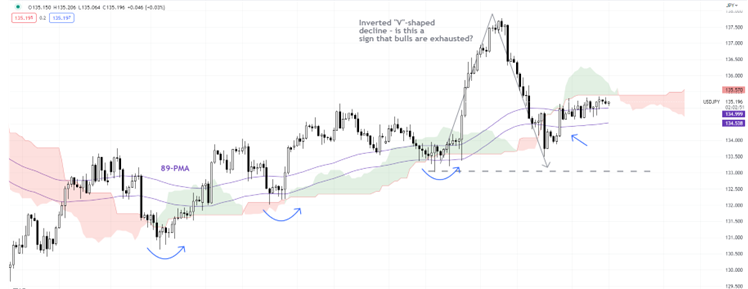

Analyzing the technical charts, the recent decline in USD/JPY, forming an inverted “V” shape, suggests waning momentum among bullish traders. Should the pair break below the immediate crucial support level at the April 27 low of 133.00, it would pose a significant threat to the six-week-long rebound. Moreover, the failure to surpass strong resistance at the March high of 138.00, which roughly aligns with the 200-day moving average, raises concerns for further gains. A breach of the 133.00 level could expose downside risks, potentially leading the currency pair toward the March low of 129.65.

Technical Chart

The outcome of the US CPI data release is highly anticipated as it carries the potential to confirm or challenge prevailing market sentiments regarding the USD/JPY exchange rate. A higher-than-expected CPI figure would likely strengthen the case for the Federal Reserve to cut interest rates, further curbing the upside potential for the US dollar and potentially benefiting the Japanese yen.

In contrast, if the US CPI data reveals a softer inflation reading, it could weaken expectations of a significant interest rate cut by the Federal Reserve, providing some support to the USD/JPY pair. Consequently, the recent rebound in the yen may be sustained or even extended against certain currency peers.

It is essential for traders and investors to closely monitor both the US CPI data release and any subsequent central bank policy adjustments. These factors will play a crucial role in determining the future direction of the USD/JPY exchange rate and the overall strength of the Japanese yen against its major counterparts.

- In conclusion, the upcoming US CPI data release will be a vital catalyst in determining whether the recent rebound in the Japanese yen is merely a short-lived phenomenon or the beginning of a sustained upward trend. Alongside expectations of potential interest rate cuts by the US Federal Reserve and the possibility of policy adjustments by the Bank of Japan, market participants should remain vigilant and adapt their strategies accordingly to navigate the evolving currency markets.