Gold prices climb following the release of U.S. CPI data indicating a continued moderation in inflation

FUNDAMENTAL OVERVIEW:

- Gold prices increased following the release of cooler-than-expected US Consumer Price Index data for June, which suggests a higher likelihood of a rate cut in September—a favorable factor for Gold.

- Additionally, Gold extends its gains as Federal Reserve Chairman Powell adopts a cautiously optimistic stance during his testimony to lawmakers in Washington.

Gold (XAU/USD) is trading above the $2,400 level on Thursday following the release of June’s US Consumer Price Index (CPI) data, indicating a slowdown in price pressures. The lower-than-expected CPI figures increase the likelihood that the Federal Reserve (Fed) will consider interest rate cuts shortly, which typically benefits Gold by reducing the opportunity cost of holding the non-interest-bearing asset.

Gold is also gaining from recent reports indicating ongoing accumulation by central banks globally. This trend persists despite the announcement on Sunday that the People’s Bank of China (PBoC), the largest consumer of Gold, halted purchases for the second consecutive month in June, after an extensive 18-month buying spree.

Gold surged on Thursday following the release of US CPI data indicating a slowdown in the economy, which suggests potential interest rate cuts in the US. This scenario enhances Gold’s appeal as an investment.

GOLD TECHNICAL ANALYSIS DAILY CHART:

Technical Overview:

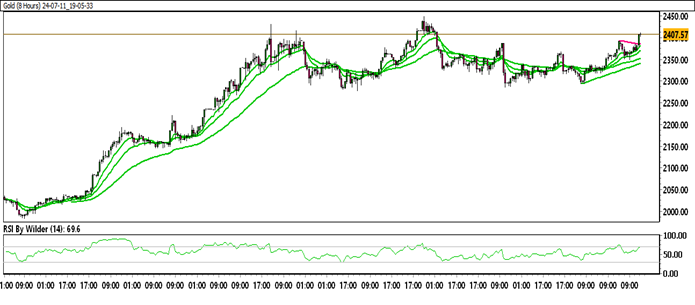

Gold is trading within an up channel.

Gold is moving above all the Moving Averages (SMA).

The Relative Strength Index (RSI) is in the Buying Zone, while the Stochastic oscillator suggests a Positive trend.

Immediate Resistance level: 2410.54

Immediate support level: 2387.85

HOW TO TRADE GOLD

Gold prices surged recently, but then pulled back and settled into a trading range. It seems to be breaking out of that range with a recent jump above a key resistance level. The price is currently testing a support zone again. Gold could be poised for further gains if it can hold above this support.

TRADE SUGGESTION- Limit Buy– 2391.20, TAKE PROFIT AT- 2414.79, SL AT- 2377.29.