The Australian Dollar continues to hold its position above a significant level ahead of US housing data.

- The Australian Dollar encounters difficulties amid a risk-off sentiment, with Australia’s Employment Change report failing to bolster the AUD.

- Additionally, US Initial Jobless Claims have surged to 231K, marking the highest level in almost three months.

On Friday, the Australian Dollar (AUD) confronts difficulties and sustains losses, even in the wake of unfavourable economic data from the United States (US) released on Thursday. The AUD/USD pair’s decline could be linked to prevailing risk-off sentiment, potentially influenced by uncertainty within the Federal Reserve (Fed) regarding the trajectory of interest rates. Nevertheless, the subdued conditions in the US labour market, coupled with recent inflation data, support the view that the Fed is unlikely to pursue further interest rate hikes.

Despite a positive Australian jobs report and increased inflation expectations, the Australian Dollar (AUD) did not experience gains. The seasonally adjusted Employment Change for October surpassed market expectations significantly. Nevertheless, the predominance of part-time positions among the added jobs somewhat mitigated the overall positive impact of the headline figures.

The US Dollar Index (DXY) exhibits a sideways trend with a slight negative inclination following a volatile session that ultimately favoured the Greenback. Despite weaker US economic data and declining US bond yields, the US Dollar (USD) successfully regained lost ground. On Thursday, the yield on the 10-year Treasury note reached a low point at 4.43%.

In the near future, the forthcoming US housing data scheduled for Friday is anticipated to offer new perspectives on the housing sector, potentially impacting trading decisions in pairs such as AUD/USD.

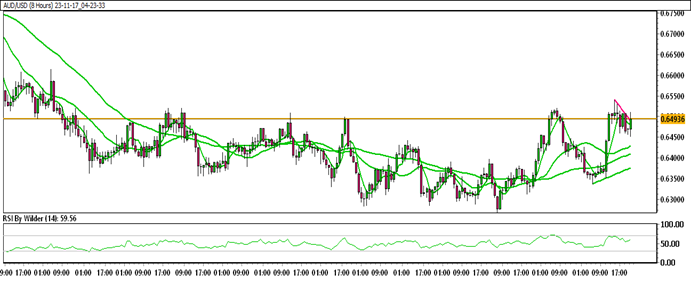

AUD/USD TECHNICAL ANALYSIS DAILY CHART:

Technical Overview

AUD/USD is currently trading within an up channel.

AUD/USD is positioned above all Moving Averages (SMA).

The Relative Strength Index (RSI) is in the buying zone, while the Stochastic oscillator suggests a neutral trend.

Immediate Resistance level: 0.6512

Immediate support level: 0.6432

HOW TO TRADE AUD/USD

After experiencing a sharp decline, the AUD/USD has stabilized and entered a consolidation phase within a specific range. Currently, the pair is making efforts to sustain an upward movement. It is presently trading around a crucial resistance zone that it has tested on multiple occasions. A breakthrough of this resistance level may indicate the potential for further upward movement.

TRADE SUGGESTION- STOP BUY – 0.6527, TAKE PROFIT AT- 0.6598, SL AT- 0.6486.