USD/CAD falls to a four-month low at 1.3270 in anticipation of the US Core PCE data.

FUNDAMENTAL OVERVIEW:

- USD/CAD faces downward pressure amid a weakened US Dollar.

- Speculation about the Federal Reserve’s dovish monetary policy stance is strengthened by US real GDP.

- Additionally, a higher WTI price might offer support for the Canadian Dollar.

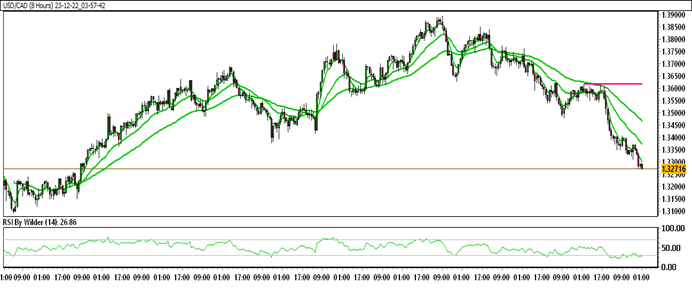

During the Asian session on Friday, USD/CAD hovers around 1.3280, near its recent four-month low at 1.3275. The pair witnessed a decline due to a weaker US Dollar, possibly influenced by softer economic data released on Thursday. Additionally, mixed Retail Sales data from Canada may have offered slight support to the Canadian Dollar.

For the second consecutive session, USD/CAD continues its decline, staying near its four-month low at 1.3270 during the European hours on Friday.

The Moving Average Convergence Divergence (MACD) indicator for the USD/CAD pair is signaling a potential bearish trend. The position of the MACD line below the centreline, along with divergence below the signal line, suggests a probable continuation of the downward trend.

Traders will monitor Canada’s October Gross Domestic Product (MoM), anticipating an improvement. In the United States, attention will be on Friday’s Core Personal Consumption Expenditures – Price Index data and the Michigan Consumer Sentiment Index.

USD/CAD TECHNICAL ANALYSIS DAILY CHART:

Technical Overview:

USD/CAD is currently trading within a down channel.

USD/CAD is positioned below all the Moving Averages (SMA).

The Relative Strength Index (RSI) is in the selling zone, while the Stochastic oscillator suggests a negative trend.

Immediate Resistance level: 1.3328

Immediate support level: 1.3258

HOW TO TRADE USD/CAD

After a notable increase, USD/CAD encountered resistance, leading to a sharp decline and establishing a lower low structure. Currently, the price is rapidly approaching a significant support zone, and a break below this level could potentially lead to further downside movement.

TRADE SUGGESTION- STOP SELL– 1.3244, TAKE PROFIT AT- 1.3150, SL AT- 1.3322.