The USD/CAD price stays restrained below the 1.3500 level.

FUNDAMENTAL OVERVIEW:

- Trading laterally beneath 1.3500, USD/CAD mimics the trajectory of the US Dollar, with Fed Waller advising against hasty rate cuts.

- Additionally, Canadian Retail Sales for December outperformed expectations.

In the European session on Friday, the USD/CAD pair retraces to approximately 1.3480, unable to maintain levels beyond the psychological barrier of 1.3500. The restrained performance of the US Dollar influences the Loonie’s movement. Following a robust rebound, the US Dollar Index (DXY) adopts a sideways trend as investors seek new insights into the Federal Reserve’s stance on interest rates.

S&P500 futures show little movement during the European session, reflecting a calm market sentiment. The USD Index lingers around 104.00, despite Federal Reserve policymakers emphasizing the requirement for additional evidence before gaining confidence in a sustained decline of inflation towards the 2% target.

Despite strong Retail Sales data for December, the Canadian Dollar doesn’t capitalize on the positive figures. Monthly Retail Sales exceeded expectations at 0.9%, compared to the anticipated 0.8%, showcasing a significant improvement from November’s stagnant performance. However, it has contributed to a persistent challenge in the inflation outlook.

USD/CAD TECHNICAL ANALYSIS DAILY CHART:

Technical Overview:

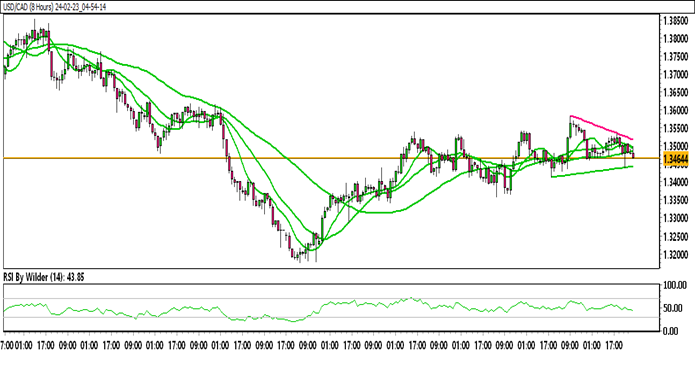

USD/CAD is trading within an up channel.

USD/CAD is positioned below all the Moving Averages (SMA).

The Relative Strength Index (RSI) is in a Neutral zone, while the Stochastic oscillator suggests a Negative trend.

Immediate Resistance level: 1.3507

Immediate support level: 1.3462

HOW TO TRADE USD/CAD

After a sharp decline, USD/CAD initially reversed its downward movement, attempting an upside. However, the sustainability was short-lived, resulting in a fall. It is trading in a support zone, and a breakdown of this zone could potentially lead to further declines.

TRADE SUGGESTION- STOP SELL– 1.3457, TAKE PROFIT AT- 1.3400, SL AT- 1.3500.