USD/CHF edges closer to the 0.9050 mark as geopolitical tensions in the Middle East ease.

FUNDAMENTAL OVERVIEW:

- The USD/CHF pair inches upwards as the US Dollar strengthens due to reduced expectations of a Fed rate cut in June.

- Diminished tensions in the Middle East may decrease demand for the safe-haven CHF, while higher US Treasury yields are bolstering support for the Greenback.

The USD/CHF climbed for the second day in a row on Monday, reaching close to 0.9050 during European trading hours. Israel’s move to withdraw more troops from Southern Gaza, possibly under increasing international pressure, has helped ease tensions. Additionally, peace negotiations between Israel and Hamas have resumed in Egypt, reducing concerns that could weaken demand for the Swiss Franc as a safe-haven currency.

Elsewhere, the Swiss Unemployment Rate, without seasonal adjustments, rose by 2.3% compared to the previous month in March, a slight uptick from the previous increase of 2.2%. In March 2024, the unemployment rate remained at 2.4%, unchanged from the prior month when not adjusted for seasonal factors.

The NFP (Non-Farm Payrolls) data revealed a notable surge of 303,000 jobs in March, exceeding forecasts of 200,000. However, the earlier growth figure of 275,000 was adjusted downward to 270,000. Moreover, US Average Hourly Earnings saw a 0.3% increase month-on-month in March, in line with expectations. Annually, there was a 4.1% uptick, consistent with market predictions but slightly below the previous reading of 4.3%.

As per the CME FedWatch Tool, the likelihood of a rate cut has fallen to 46.1%. Traders are currently anticipating the upcoming release of US Consumer Price Index data for March, set to be unveiled on Wednesday.

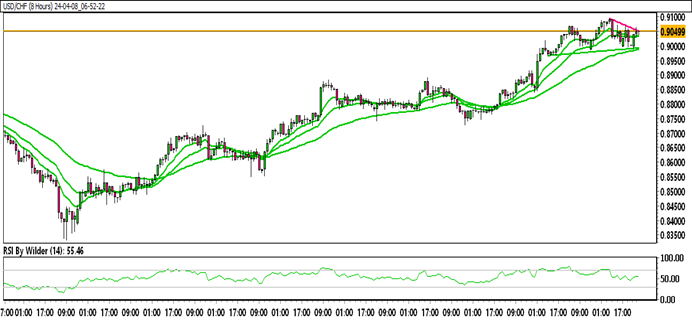

USD/CHF TECHNICAL ANALYSIS DAILY CHART:

Technical Overview:

USD/CHF is currently trading within an up channel.

USD/CHF is positioned above all Moving Averages (SMA).

The Relative Strength Index (RSI) is in the Buying zone, while the Stochastic oscillator suggests a Positive trend.

Immediate Resistance level: 0.9053

Immediate support level: 0.9072

HOW TO TRADE USD/CHF

After experiencing a decline, USD/CHF found support and reversed its direction upwards. It began retracing higher after forming a higher structure. The price has paused its movement and is trading around a crucial resistance zone. If this zone is breached, further upside movement is anticipated.