USD/CHF gains fresh weekly highs and consolidates near the 0.9000 major level.

- For the fourth consecutive day, USD/CHF continues its upward momentum in anticipation of the US Core PCE Price Index release.

- A potential rise in US Treasury yields might bolster the US Dollar.

- However, USD bulls may encounter resistance as the expected outcome of the upcoming FOMC meeting suggests that policy rates will remain unchanged.

USD/CHF continues its positive run that was initiated on Tuesday, reaching fresh weekly highs around 0.9000 in the Asian session this Friday. The US Dollar (USD) faces some challenges in its ascent but has the potential for support as US Treasury yields rebound after experiencing losses in the previous session, with the 10-year US bond yield currently at 4.87%.

The Swiss Franc (CHF) might experience a turbulent path due to disappointing ZEW Survey Expectations, with Switzerland’s business conditions and labor market indicating a decline from a previous decrease of 27.6 in October to 37.8.

Furthermore, the USD/CHF pair stands to benefit from the positive momentum generated by the strong US preliminary Gross Domestic Product (GDP) Annualized figures released on Thursday. However, the report also unveiled preliminary core Personal Consumption Expenditures (PCE) data that fell short of expectations, leading to increased demand for US bonds.

In the third quarter, US GDP expanded by 4.9%, surpassing the earlier growth of 2.1% and exceeding the anticipated 4.2%. Conversely, US Core PCE declined to 2.4% in Q3, down from the previous 3.7%.

The USD/CHF bulls may encounter resistance as the consensus suggests policy rates will remain unchanged in the forthcoming Federal Open Market Committee (FOMC) meeting next week. Furthermore, Friday will witness the release of the core Personal Consumption Expenditures (PCE) Price Index data later during the North American session, a crucial indicator of inflation in the United States.

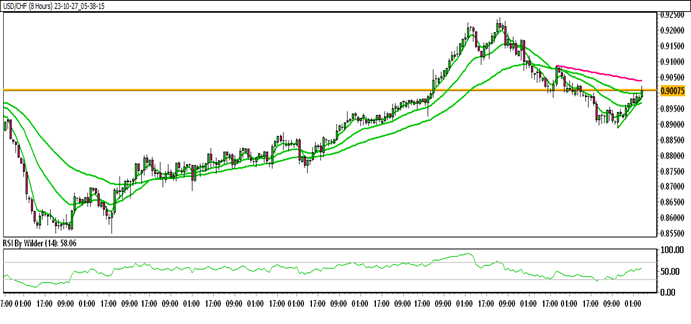

USD/CHF TECHNICAL ANALYSIS DAILY CHART:

Technical Overview

USD/CHF is currently trading within an up channel.

USD/CHF is positioned above all Moving Averages (SMA).

The Relative Strength Index (RSI) is in the buying zone, while the Stochastic oscillator suggests a positive trend.

Immediate Resistance level: 0.9023

Immediate support level: 0.8939

HOW TO TRADE USD/CHF

Following a significant upward movement, the USD/CHF price faced resistance, prompting a reversal to the downside. However, after retracing to the 61.8% Fibonacci level, it discovered support and subsequently resumed its upward trajectory. Presently, it is trading near a critical resistance level, and if this level is breached, we can anticipate further upward movement.

TRADE SUGGESTION- STOP BUY – 0.9088, TAKE PROFIT AT- 0.9210, SL AT- 0.9002.