USD/CHF aims to continue a five-day winning streak, and trades near 0.9030.

FUNDAMENTAL OVERVIEW

- Despite the lackluster performance of the US Dollar, the USD/CHF pair continues its upward trajectory.

- The ongoing Israel-Hamas conflict may offer support to the Swiss Franc as a safe-haven currency.

- Additionally, the Greenback was weighed down by a disappointing US Core PCE Price Index (Year-on-Year), but it might find support in the rebound of the 10-year US Bond yield.

USD/CHF strives to extend its winning streak, hovering around the 0.9030 level in the Asian session on Monday. Despite the somewhat lackluster performance of the US Dollar (USD), the USD/CHF pair maintains its upward momentum.

The Greenback encounters resistance as the market anticipates that the US Federal Reserve (Fed) will likely maintain the interest rates at 5.5% in the upcoming meeting on Wednesday.

Furthermore, the US Core Personal Consumption Expenditures Price Index (Year-on-Year) showed a modest dip to 3.7% in September from the 3.8% recorded in August, which could potentially constrain the advances of the USD/CHF pair. However, the monthly data revealed a 0.3% increase, meeting expectations and surpassing the previous figure of 0.1%, yet this failed to invigorate the US Dollar.

The Swiss Franc (CHF) may find support against the USD due to the intensification of the Middle East conflict, with Israel expanding its ground operations in Gaza and targeting multiple Hamas sites.

In the upcoming week, investors will keep a close eye on US economic indicators such as the ADP Employment Change and ISM Manufacturing PMI for October. Meanwhile, Swiss economic data to watch includes the Real Retail Sales (Year-on-Year) report scheduled for Tuesday.

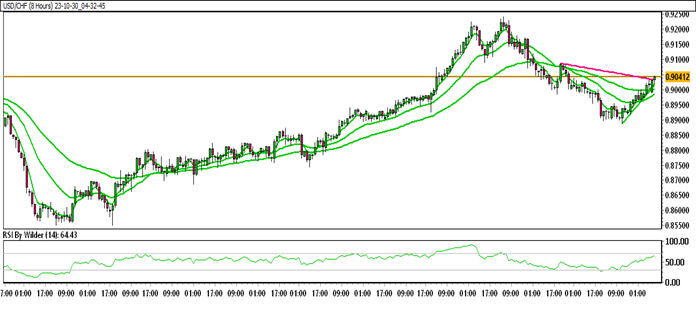

USD/CHF TECHNICAL ANALYSIS DAILY CHART:

Technical Overview

USD/CHF currently trading within an up channel.

USD/CHF is positioned above all Moving Averages (SMA).

The Relative Strength Index (RSI) is in the buying zone, while the Stochastic oscillator suggests a positive trend.

Immediate Resistance level: 0.9051

Immediate support level: 0.8987

HOW TO TRADE USD/CHF

After a significant upward move, USD/CHF experienced a retracement to the 61.8% Fibonacci zone, where it established a support base before making another attempt to move higher. Presently, the pair is trading near a crucial resistance level, and a break above this level is anticipated to result in further upward movement.

TRADE SUGGESTION- STOP BUY– 0.9080, TAKE PROFIT AT- 0.9173, SL AT- 0.9018.