FUNDAMENTAL OVERVIEW

- The USD/JPY rises to its highest point since March 10 but is unable to surpass the 200 DMA.

- The BoJ’s pessimistic view is a drag on the JPY and a positive factor in the context of a weak USD.

- To gain momentum before the FOMC meeting, investors are now watching the US ISM Manufacturing PMI.

On the first day of a new week, the USD/JPY pair builds on Friday’s massive surge and enjoys strong follow-through traction. Although spot prices pause near a technically significant 200-day Simple Moving Average (SMA) resistance just ahead of the 137.00 level, the momentum propels them to their highest level since March 10. But throughout the first half of the European session, the pair continues to be bid, and it is currently trading just above the mid-136.00s, still up about 0.25% on the day.

The dovish view of the Bank of Japan (BoJ) continues to weigh on the Japanese Yen (JPY), which together with a slight US Dollar (USD) rise works as a tailwind for the USD/JPY pair. Recall that the Japanese central bank unanimously decided not to alter its yield curve control (YCC) on Friday, keeping its ultra-loose monetary policy settings in place. In addition, the newly appointed BoJ Governor Kazuo Ueda stated that it will be prudent to sustain monetary easing to reach the 2% inflation target and noted that the risk from tightening too quickly is greater than monetary policy lagging behind the curve.

In addition, statistics made public earlier on Monday revealed that factory activity in Japan, the third-largest economy in the world, shrank for the sixth consecutive month in April, which put extra negative pressure on the JPY. The USD, on the other hand, moves upward for a third day in a row amid expectations that the Federal Reserve (Fed) will increase interest rates by another 25 basis points (bps) on Wednesday at the conclusion of a two-day meeting. The US central bank is expected to leave rates stable for the remainder of the year, according to the markets. This caps the pair and prevents USD bulls from making risky wagers.

In addition, the general market risk sentiment may help create short-term chances surrounding the USD/JPY pair. The outcome of the FOMC meeting on Wednesday and the much-anticipated US monthly employment figures, often known as the NFP report on Friday, will continue to dominate attention in the meantime. This will be crucial in determining the near-term USD price dynamics and the subsequent leg of the major’s directional move.

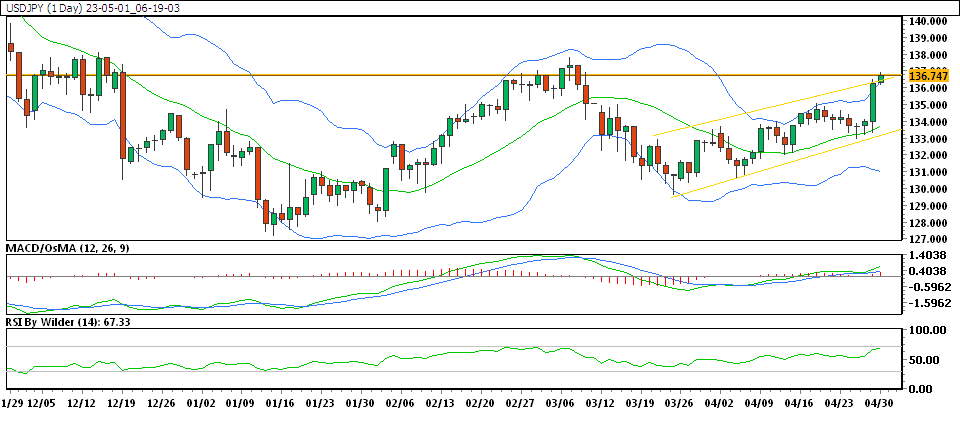

USD/JPY TECHNICAL ANALYSIS DAILY CHART:

Technical Overview

USD/JPY is currently trading in up channel.

USD/JPY is currently trading above all SMA.

RSI is in buying zone which suggests bullishness and Stochastic is suggesting up trend.

USD/JPY resistance is at 136.530 & its immediate support level is 135.939

HOW TO TRADE USD/JPY

Currently, the USD/JPY is moving up the channel and forming higher high structures. Furthermore, it has broken through its previous day’s high and is currently trading near a resistance level; if this level breaks, further upside is to be expected.