WTI trades with modest losses below the $83.00 mark, though the downside potential appears limited.

FUNDAMENTAL OVERVIEW:

- WTI attracts some sellers on Thursday due to concerns about slowing global fuel demand.

- However, escalating geopolitical tensions fuel supply concerns, providing support for the commodity.

- Additionally, expectations of a September Fed rate cut weaken the USD, helping to limit losses for oil prices.

West Texas Intermediate (WTI) US crude oil prices ticked lower during the Asian session on Thursday but lacked follow-through selling, remaining close to the highest level since April 26 reached earlier this week. The commodity remains in a three-day-old trading band, currently just below the $83.00 mark.

US data released on Wednesday indicated signs of labor market weakness and a cooling economy. Coupled with China’s economic troubles, this raises concerns about a global economic slowdown, which is expected to reduce long-term fuel demand and put downward pressure on crude oil prices. However, ongoing conflicts in the Middle East continue to pose supply risks, providing some support for oil prices.

Tensions between Israel and Lebanon’s Hezbollah show little signs of de-escalating. Additionally, Ukrainian attacks on Russian refineries raise concerns about supply disruptions from key oil-producing countries. Expectations of peak summer fuel consumption and OPEC+ cuts in the third quarter could lead to a global oil market supply deficit, deterring traders from placing aggressive bearish bets on the commodity.

Dig Deeper – U.S. INFLATION HITS 2.6% IN MAY, COULD INFLUENCE 2024 FED RATE CUTS.

Meanwhile, the recent softer US economic data reinforces market expectations that the Federal Reserve will begin cutting interest rates in September and reduce borrowing costs again in December. This has caused US Treasury bond yields to slump and dragged the US Dollar to a three-week low, potentially providing additional support to crude oil prices. Consequently, caution is warranted before positioning for deeper losses ahead of the US Nonfarm Payrolls (NFP) report on Friday.

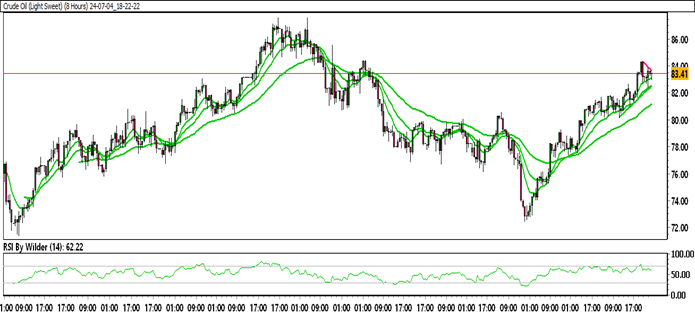

CRUDE OIL TECHNICAL ANALYSIS DAILY CHART:

Technical Overview:

Crude Oil is currently trading within the up channel.

Crude Oil is positioned above all the Moving Averages (SMA).

The Relative Strength Index (RSI) is in the Buying zone, while the Stochastic oscillator suggests a Neutral trend.

Immediate Resistance level: 83.83

Immediate support level: 82.70

HOW TO TRADE CRUDE OIL

After a sharp rise, crude oil encountered resistance and reversed to the downside, forming lower lows. It then found support and surged aggressively upward. Currently, the price is trading around a key resistance zone. If this zone is broken, further upside movement is possible.